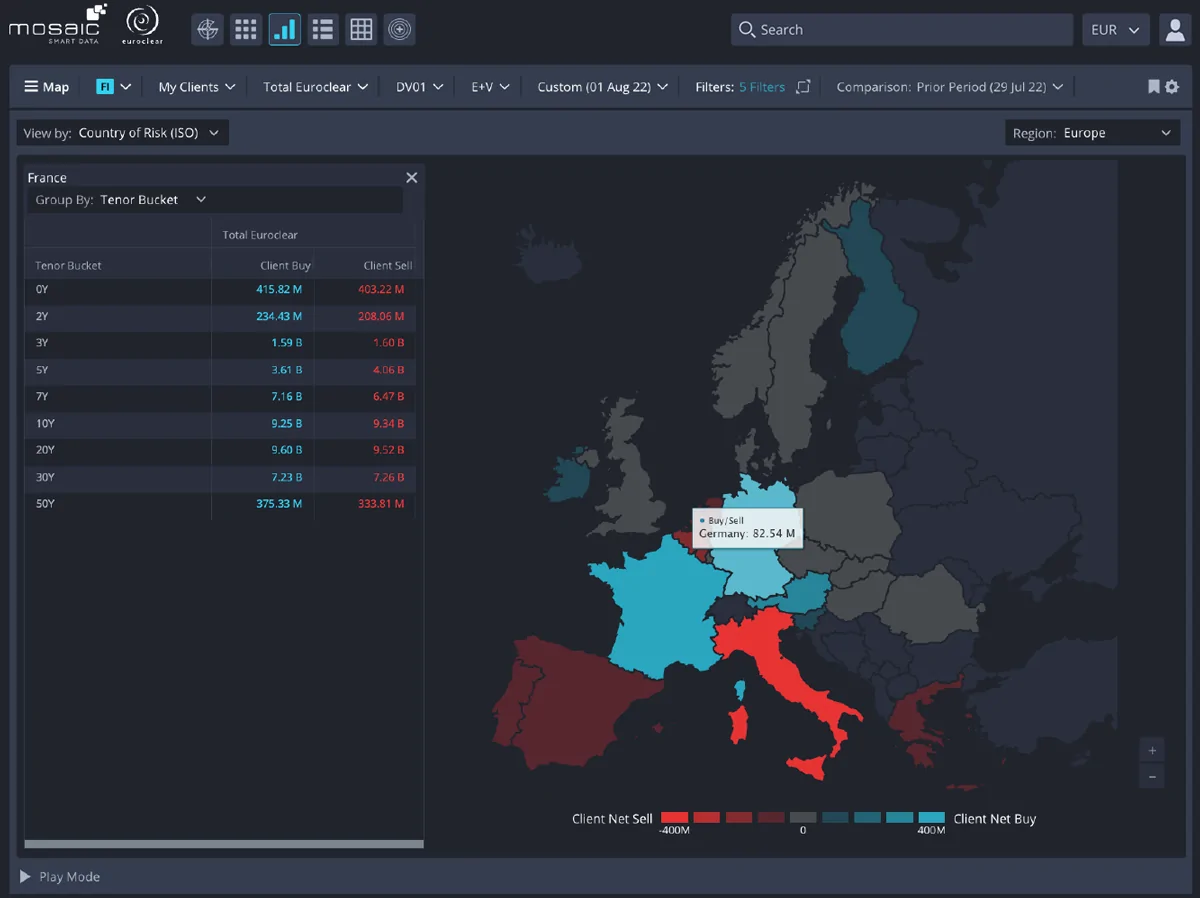

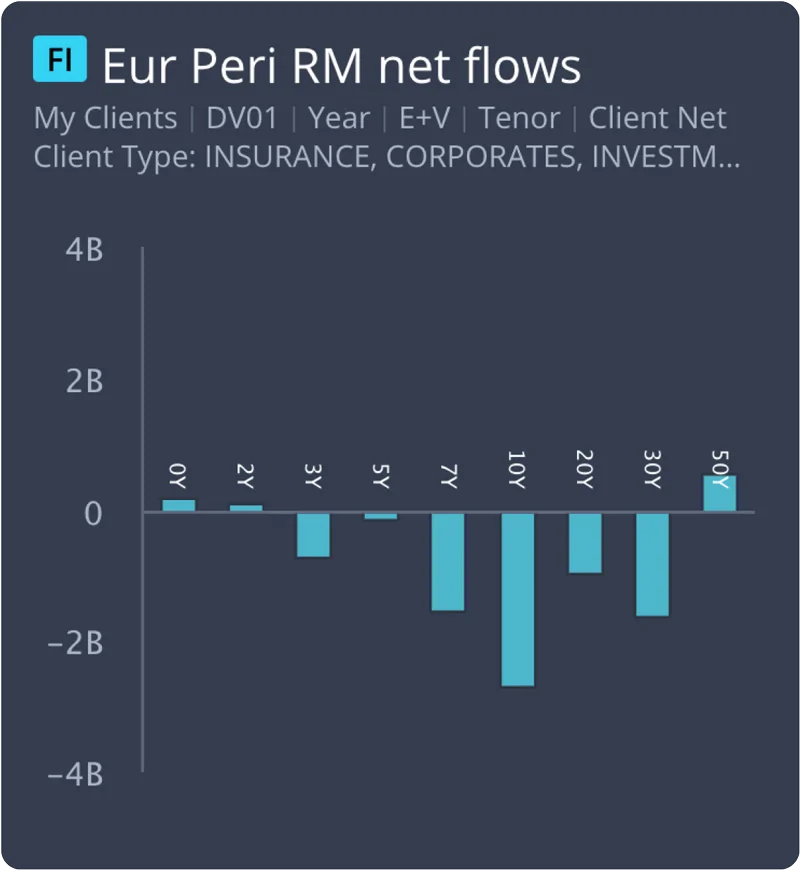

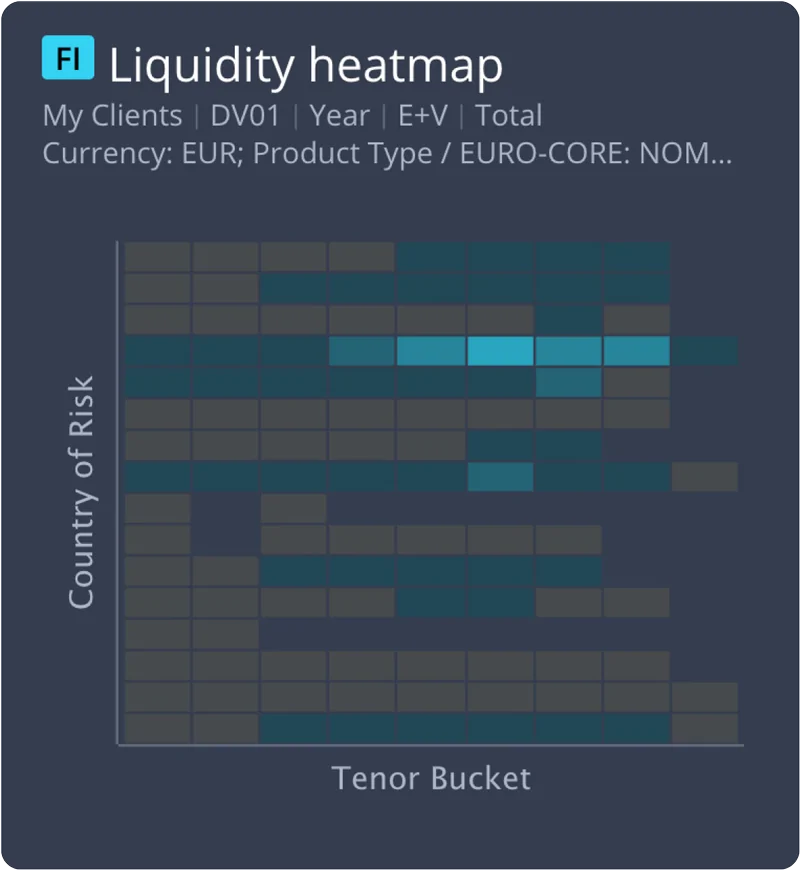

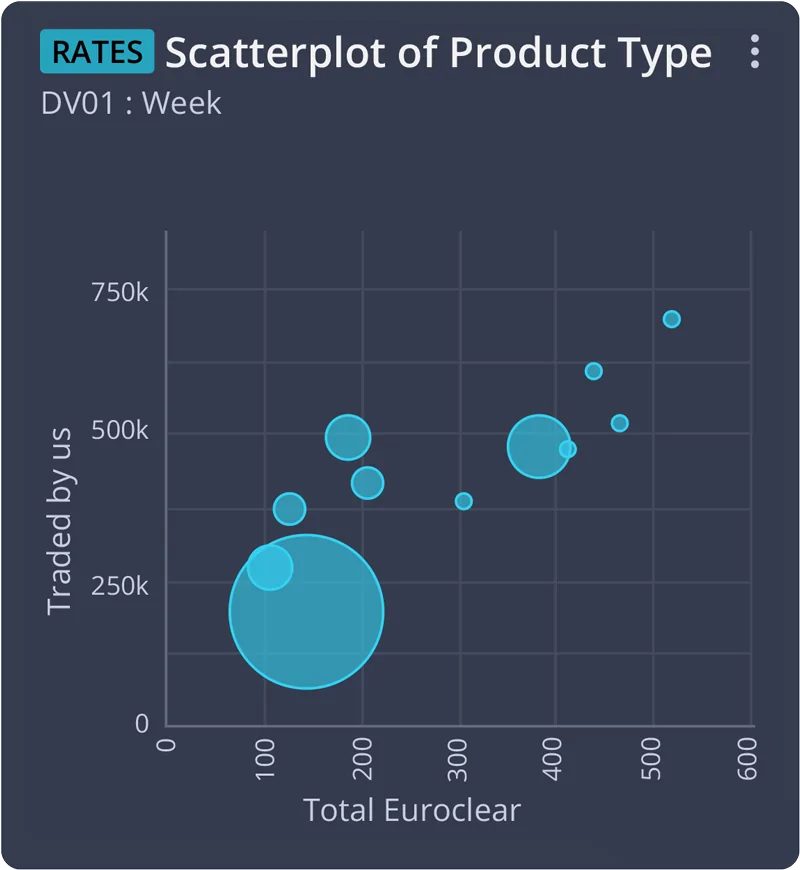

London/Brussels, 24 June 2024: Mosaic Smart Data (Mosaic), the real-time capital markets data analytics company, has launched a next generation data intelligence service, Smart Markets, powered by financial markets infrastructure provider Euroclear’s fixed income data including government and corporate bonds. The launch marks a new era for data in capital markets, transforming Euroclear’s data into insights that participants can easily interpret and use to detect market movements, enhance trading models and build informed strategies.

Leveraging Mosaic’s cutting edge AI and machine learning technology, Smart Markets has been developed by Mosaic’s expert data scientists in response to the demand from institutions such as banks, central banks, debt management offices (DMOs), corporate treasurers, buy-side trading firms and hedge funds for increasingly sophisticated data-driven insights.

Demand for market data from financial institutions is booming with the market growing 12.4% in 2023 to a record $42.0 billion.[1] Data quality and the ability to interpret big data has become increasingly critical. Smart Markets answers this call by bringing together raw data from market sources such as Euroclear, which is then enriched, normalised and automatically analysed.

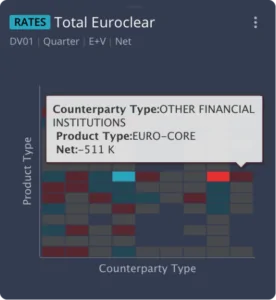

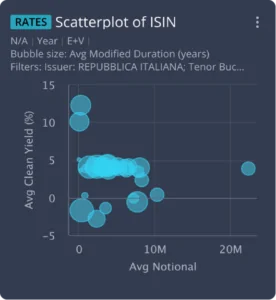

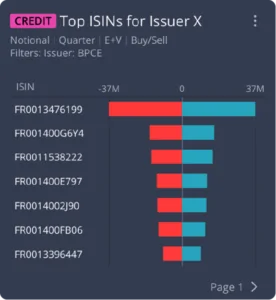

The result for FICC market participants is access to a highly intuitive, multi-asset service that unlocks new depths of understanding in the markets and products that are important to them. This enables them to enhance their trading models, build informed market strategies, strengthen their investment and research intelligence and improve post-trade analysis and reporting.

[1] Burton-Taylor: Financial Market Data/Analysis: Global Share & Segment Sizing 2024