How to access Smart Markets and setup 2FA

1.

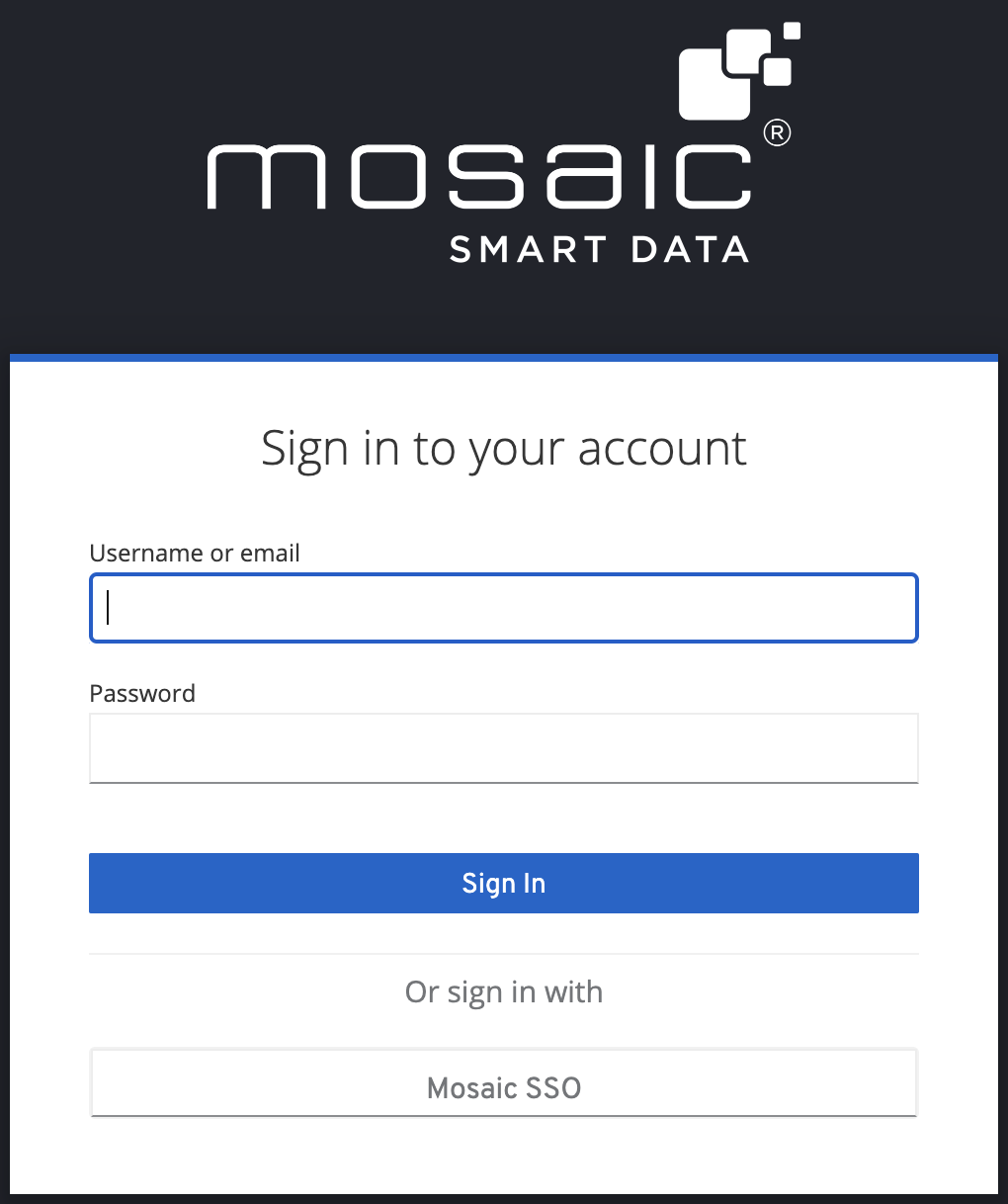

Open the Google Chrome web browser and go to: https://euroclear.

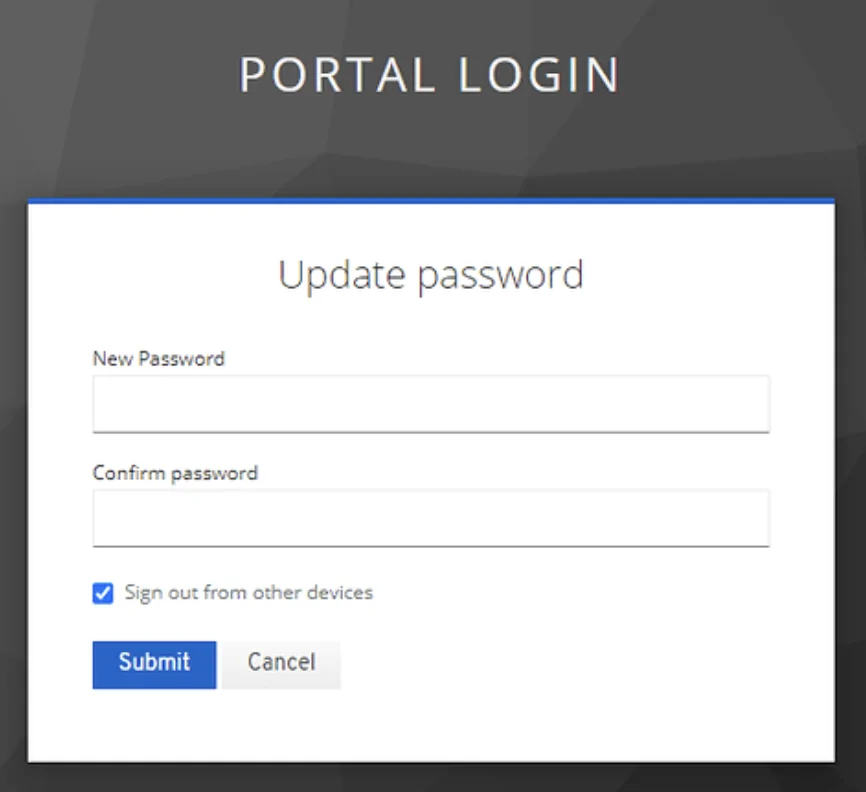

- Enter your email address and the temporary password (sent from Mosaic in a separate email).

- Click ‘Sign In‘ (please note SSO is not available during the trial)

2.

3.

4.

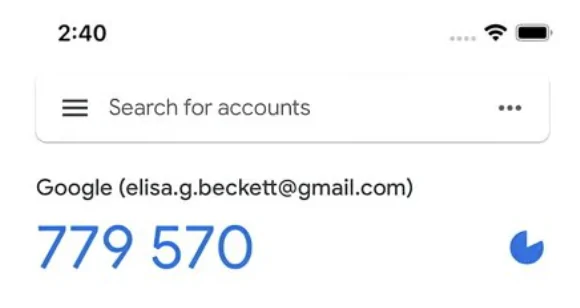

5.

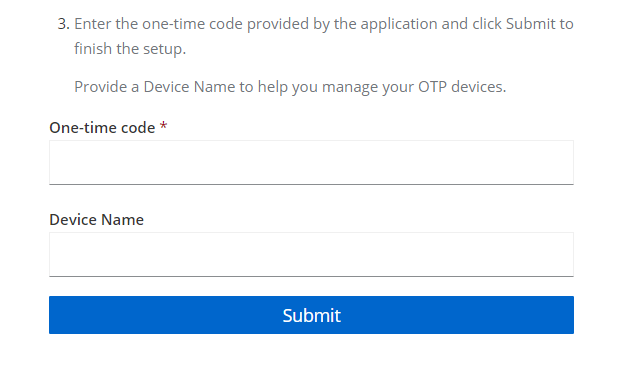

6.

7.

8.

FAQs:

Important point to note:

We receive both sides (buy and sell) of each settled trade meaning:

- ‘Total’ numbers need to be halved or use just ‘buy’ or ‘sell’ to get a true indication of settled flow.

- In most scenarios ‘net’ flow will be 0

- Filter by a counterparty type to see the net direction of trades.

When is the data published to Smart Markets?

- Data is published to Smart Markets the day after settlement.

- Dates in Mosaic are in reference to the trade date. Settlement dates are available as a dimension to filter or group data by.

What about MiFID II and Trax data?

- We’ve partnered with Euroclear following rigorous analysis as they have the most complete dataset. As data is based on actual settled trades there’s no room for fat fingers and cancellations.

What transactions are included in Smart Markets?

- All secondary market transactions which are settled within the Euroclear settlement system in Continental Europe are eligible to be published to Smart Markets, which is channel-agnostic.

- Flow analytics are not biased by Primary issuance and Repo trades.

What asset classes are included in Smart Markets?

- All global Fixed Income securities traded in Continental Europe are eligible to be published to Smart Markets. This includes Government Bonds, SSAs, Corporate Bonds.

What counterparty details are available in Smart Markets?

- To preserve market participants’ anonymity, the only available counterparty dimension is Counterparty Type (e.g. Investment Manager, Bank/Dealer, …).

- There is no Counterparty Country / Region available.

| Counterparty type | Definition |

| Broker dealers | Includes securities brokers, investment banks and capital market desks. |

| Corporates | Includes companies producing goods or non financial services. |

| Depository institution | Includes institutions involved in deposit banking or closely related functions like. |

| Government related financial institutions | Includes all government related institutions such as government agencies, infrastructure and development banks, and supra-national institutions. Central banks are excluded. |

| Insurance | Represents insurance and reinsurance companies, including insurance agents, brokers & services. |

| Investment managers | Includes all asset managers, wealth managers, fund managers, ETFs, mortgage lenders, CDOs, CLOs, and Stichtingen. |

| Market infrastructures | Includes exchanges, clearing houses, CCPs, and CSDs. |

| Other financial institutions | Includes non deposit taking financial institutions, like consumption credit lenders, fund service companies and trustees. |

| Real estate | Includes real estate operators, developers, brokers. |

| Non Euroclear | Indicates the other side of cross border trades where one party has settled the trade outside of Euroclear. |

Can I drill down to individual trades in Smart Markets?

- To preserve market participants’ anonymity, there isn’t currently the option to drill down to individual trades. Flows are only accessible at an aggregate level.

Can I access Price information as well as Volumes in Smart Markets?

- Yes, you can access both VWAP and Average Yields in Smart Markets. Both aggregated “Dirty” and “Clean” prices are available (i.e. with and without accrued interest).

- However, to preserve market participants’ anonymity, there isn’t the option to drill down to the individual trade level: prices are only accessible at an aggregate level.

What technical resources do I need to access Smart Markets?

- You can access Smart Markets with your browser (Google Chrome recommended), and there is usually no effort required from your IT department.

- Occasionally, and depending on your firewall’s setup, you might only need to whitelist Smart Markets IP address to be able to access it.

Getting an error message when trying to set up your account or login?

- Make sure you’re using your work email address (the one we’ve been contacting you on) as your username.

- Check for hidden spaces or capitalisation when entering your username and password.

- Close the page then reopen https://euroclear.mosaicsmartdata.net/ to try again.

- Still having issues? Contact smartmarkets@mosaicsmartdata.

com

I’ve forgotten my password, how do I reset it?

- Please contact smartmarkets@mosaicsmartdata.

com and a member of the team will assist.

Start a 30-day free trial

For the professional market only.