In addition to real-time data analysis, the Mosaic platform offers custom alerts and automated reporting, seasonality alerts, flow insights, client defection alerts, profitability-based insights, and anomaly detection.

Insights which the platform can deliver include:

Custom alerts and explanations

- End-user defined thresholds and alert triggers

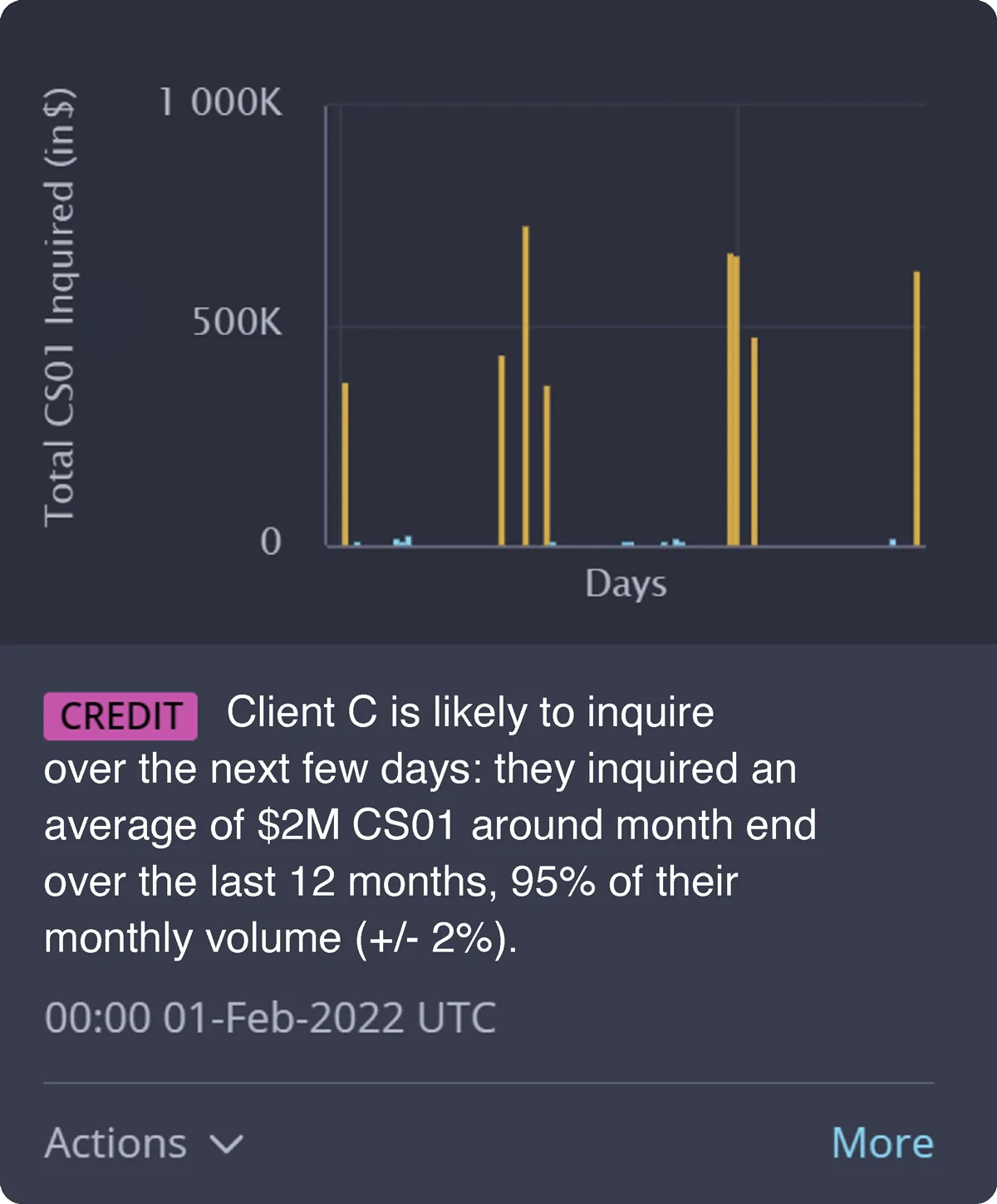

Seasonality alerts

- Clients showing strong seasonality behaviour

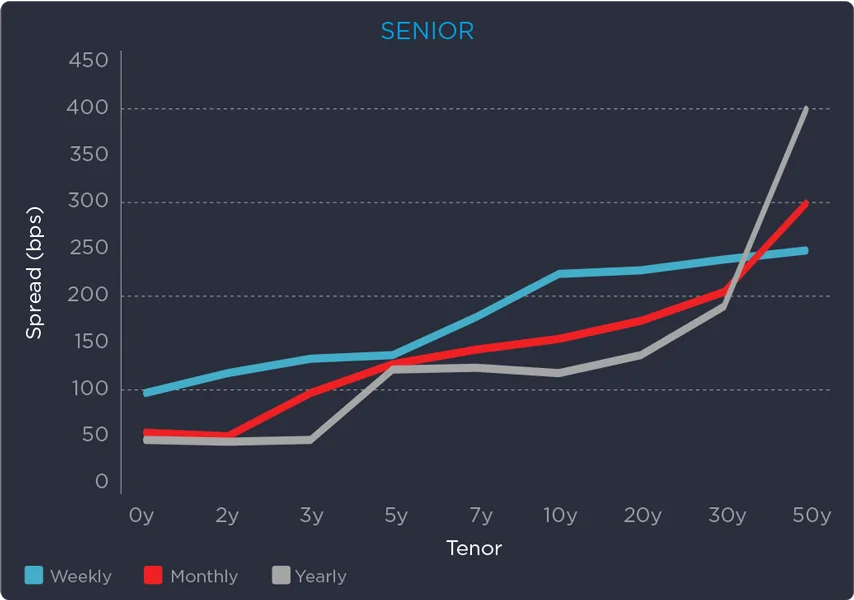

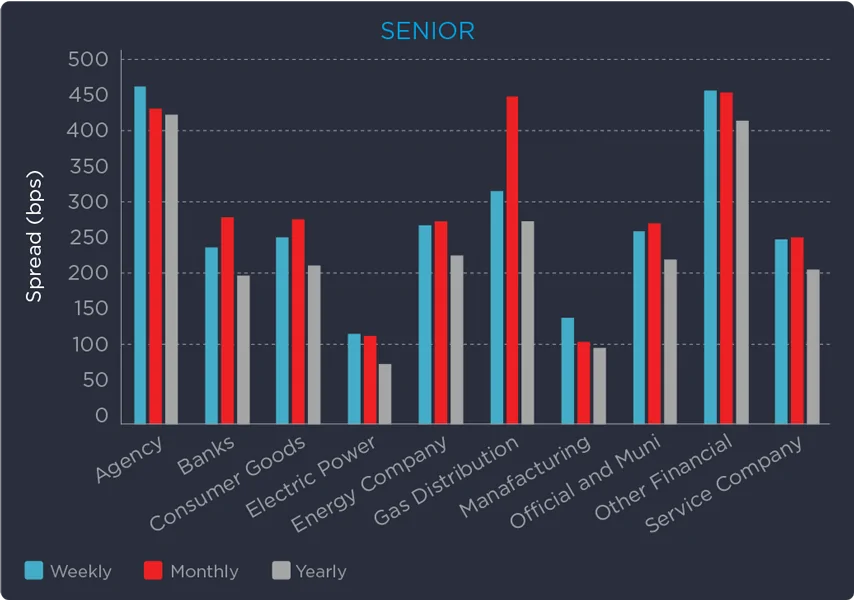

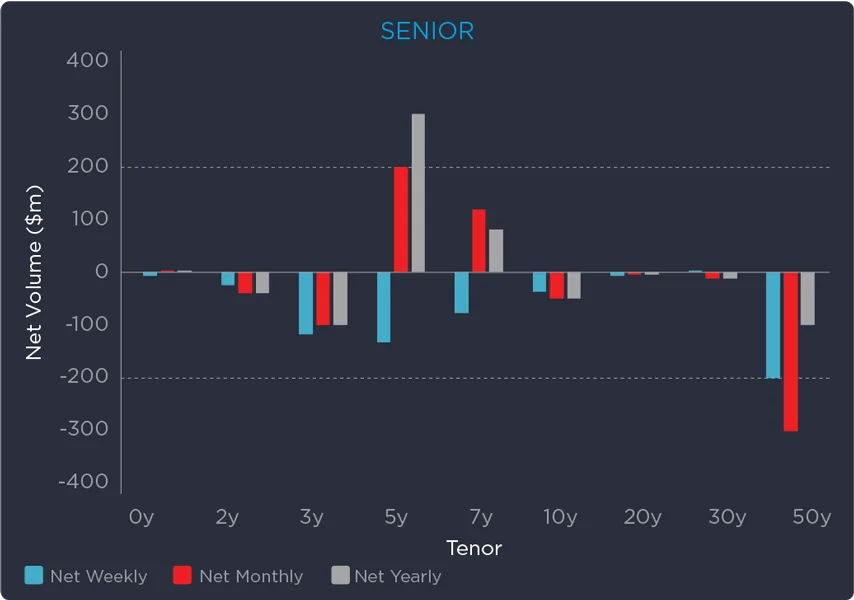

Flow insights (franchise)

- Spreads in FIN Snr are widening,

- Spreads in Manufacturing 5Y have been tightening

- Higher than usual activity in Turkish credit with clients maintaining net sell

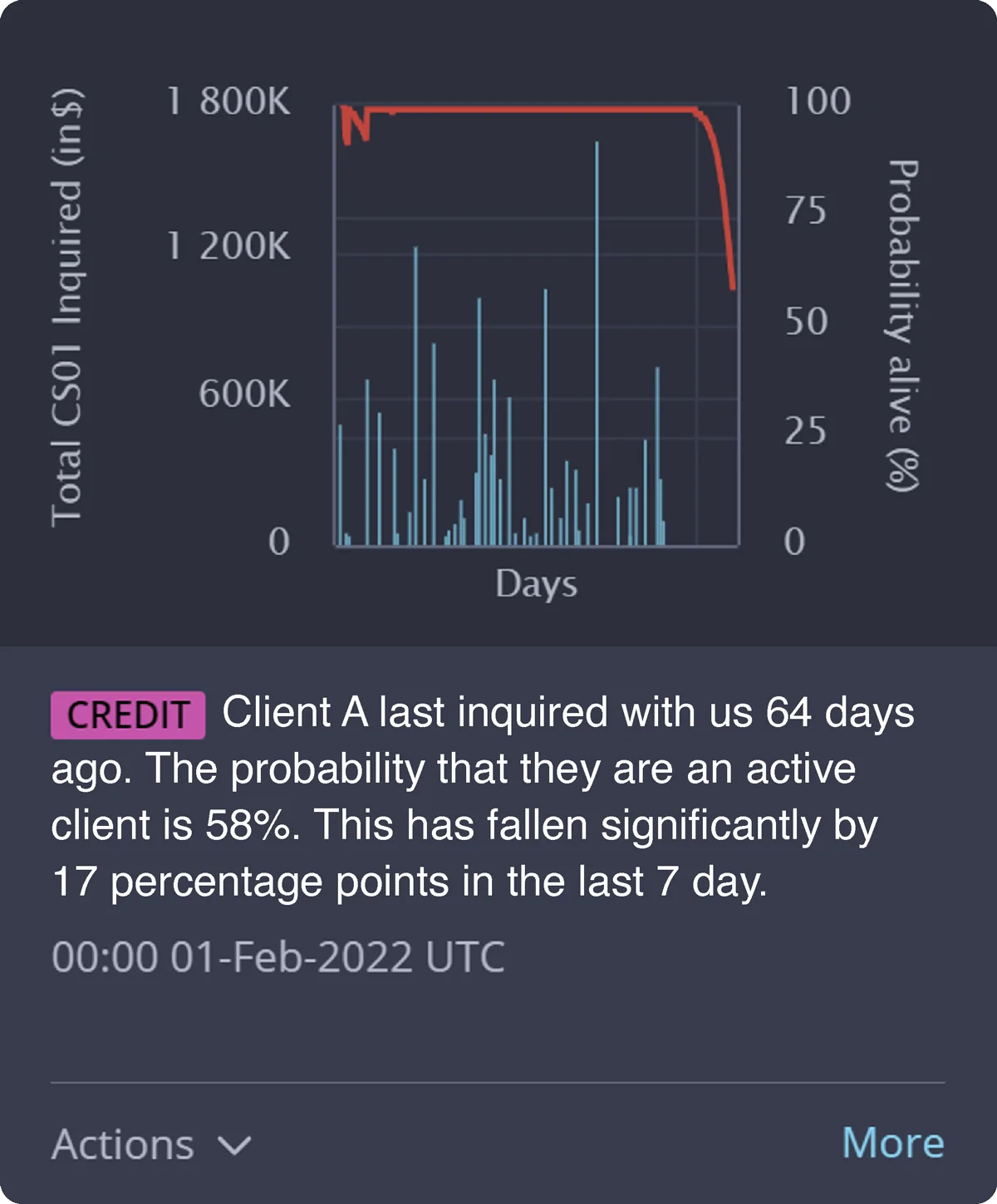

Client defections

- Which of my clients are starting to defect and the revenue attached

Profitability based insights

- Pattern detection on markouts leading to hedging recommendation

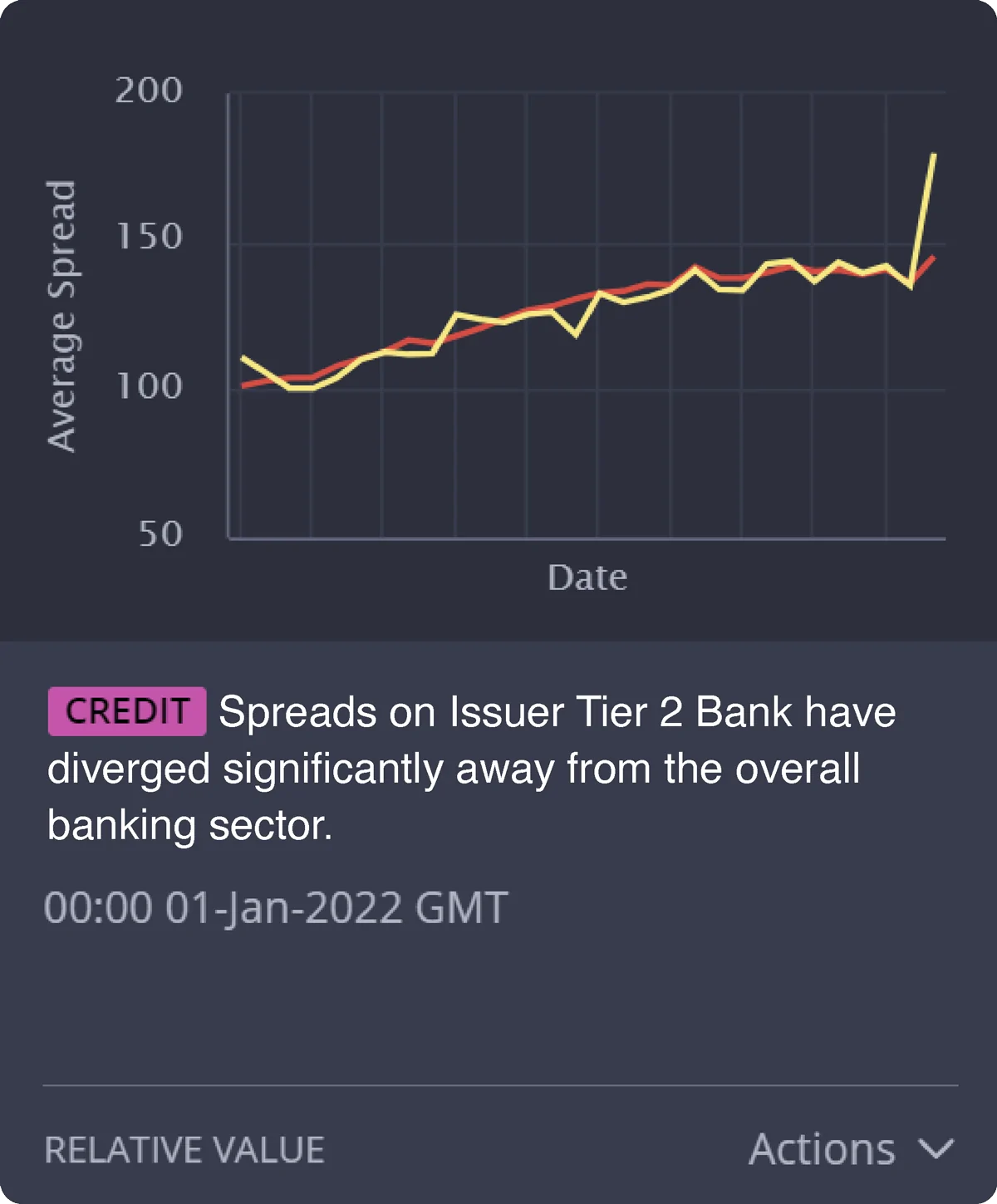

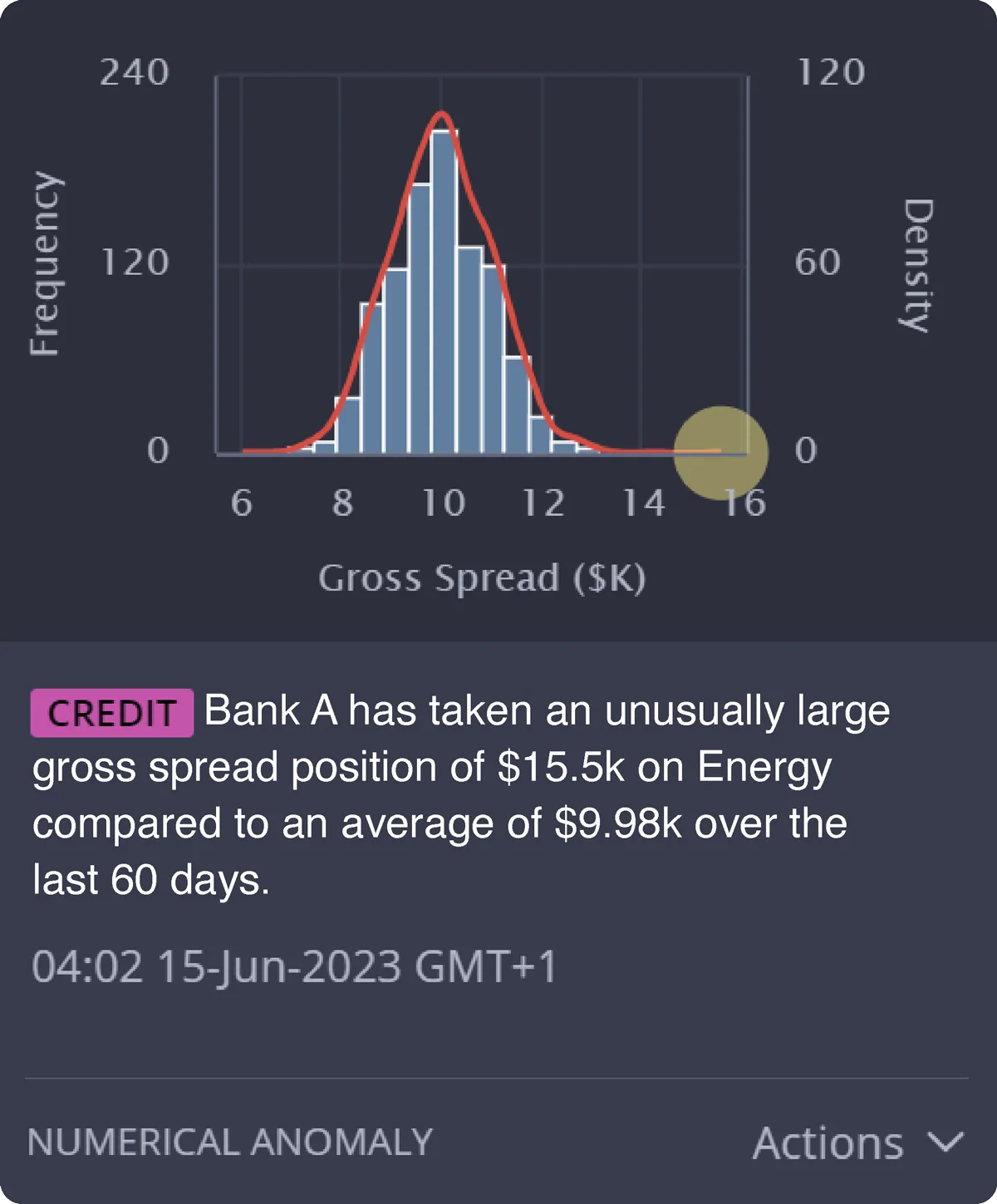

Anomaly detection

- Unusual flow patterns / activity

Bond search

- Show bonds recently active

Liquidity search

- Pinpoint the clients you need to target to trade your axes quickly:

- Find liquidity quickly and efficiently

- Optimise balance sheet utilisation

- Accelerate your market making business

- Strengthen client relationships

- Stay ahead of the competition