Aggregation and normalisation

Capable of managing high volumes of rates transaction data, Mosaic Smart Data normalises and aggregates data across all voice and electronic trading channels

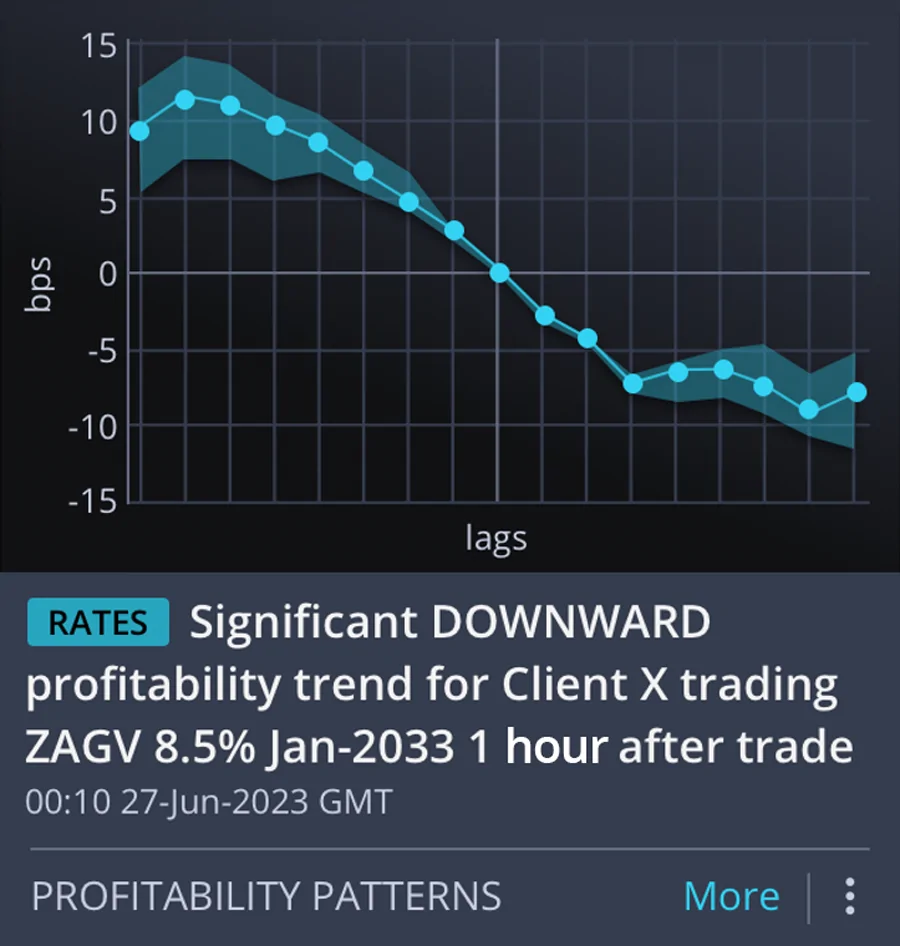

Real-time analytics

Mosaic enables banks to analyse the vast untapped pool of rates transaction and market data at their disposal in order to react in real-time

AI-driven actionable insights

Mosaic Smart Data leverages the power of ML & AI to provide insights leading to actionable steps to boost performance

Personalisation of client service

Equipped with data-driven insights, traders and salespeople can hyper-personalise the service they offer their clients in order to deepen relationships

Intuitive display

Mosaic Smart Data leverages the best and most intuitive cutting-edge design available in consumer software to create the pre-eminent user experience in financial technology today