Steps Ahead

Demystifying the complex: how to gain insight from FICC derivatives transaction data

The pandemic has accelerated electronification of fixed income trading for many banks, and with that has come a renewed focus on innovation to help them keep pace with market structure changes. In an increasingly data-centric market, nowhere has innovation been pronounced than in the field of data analytics.

Banks are increasing their technology spend with a laser focus on solutions that will help them achieve a competitive advantage – and this means turning data into actionable intelligence. In a recent survey of c-suite executives at Fortune 1000 companies, 99% reported they had invested in data initiatives and 96% stated they had achieved successful outcomes from Big Data and AI.

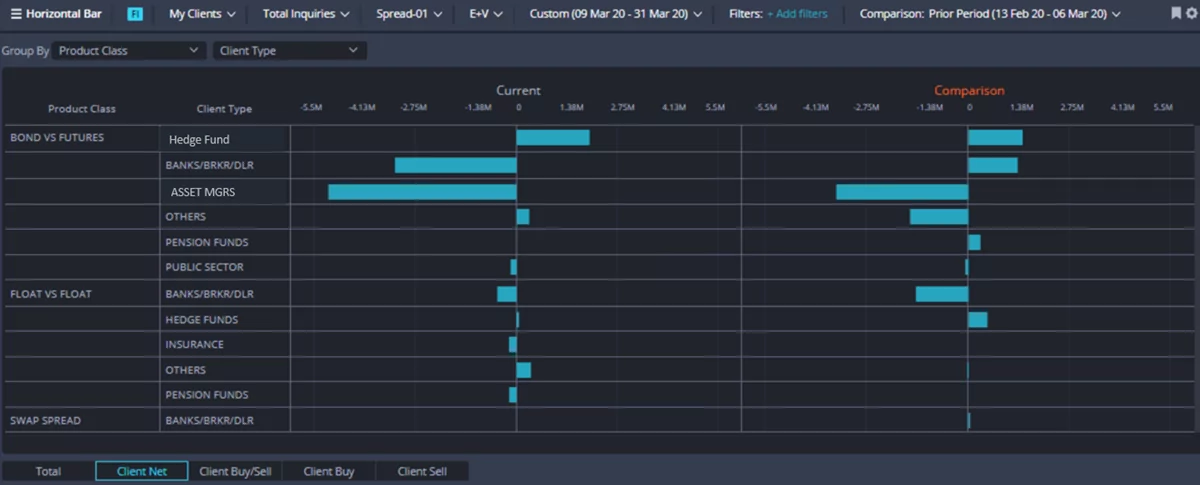

But implementing a successful FICC data analytics regime means being able to gain insight from the simplest to the most complex of transactions – normalised, aggregated and delivered on one screen.

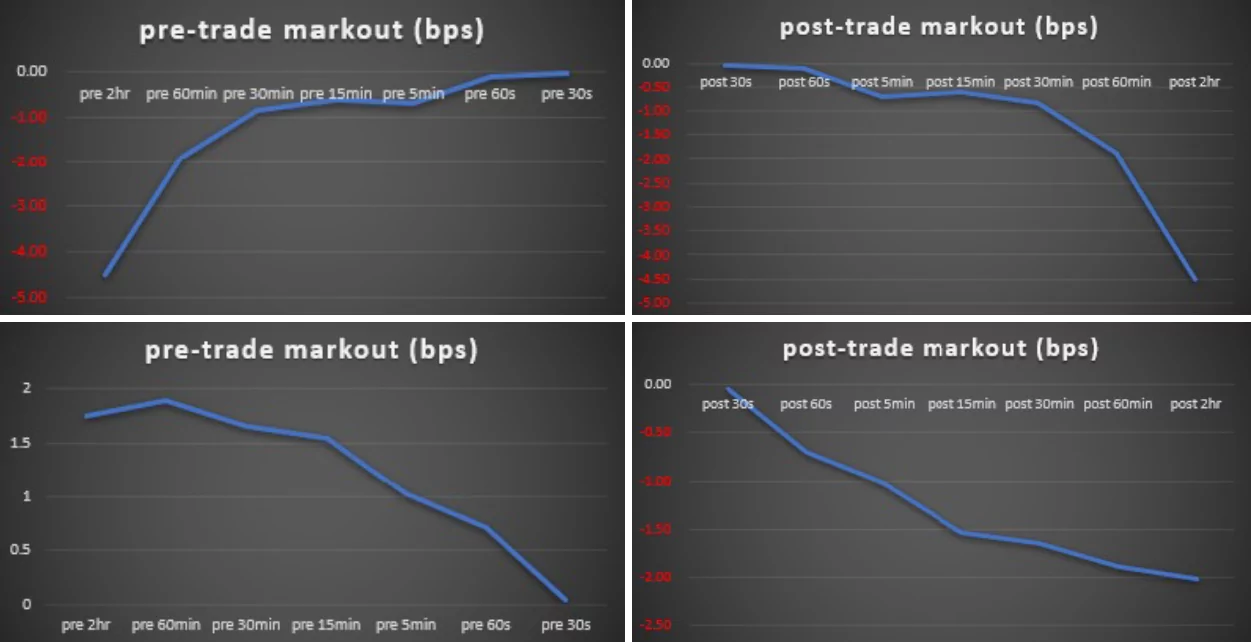

If deployed effectively, analytics is an area where banks can develop a true edge by uncovering opportunities and gaining a better understanding on when, where and how to trade. Against this backdrop, it’s unsurprising that more banks are deploying AI and machine learning to optimise workflows and enable trading desks to allocate more resource to higher-value trades, especially those that aren’t suited for electronification.

To deliver results at speed and with better ROI, many banks are partnering with service providers and specialist fintech companies to speed up digitisation.

Mosaic Smart Data’s cutting-edge analytics tools support fixed income and derivatives data, empowering banks to enhance their trading and risk management strategies. Mosaic is partnered with the European Space Agency (ESA) to apply some of the world’s most advanced data analytics models to the problems banks face in financial markets.

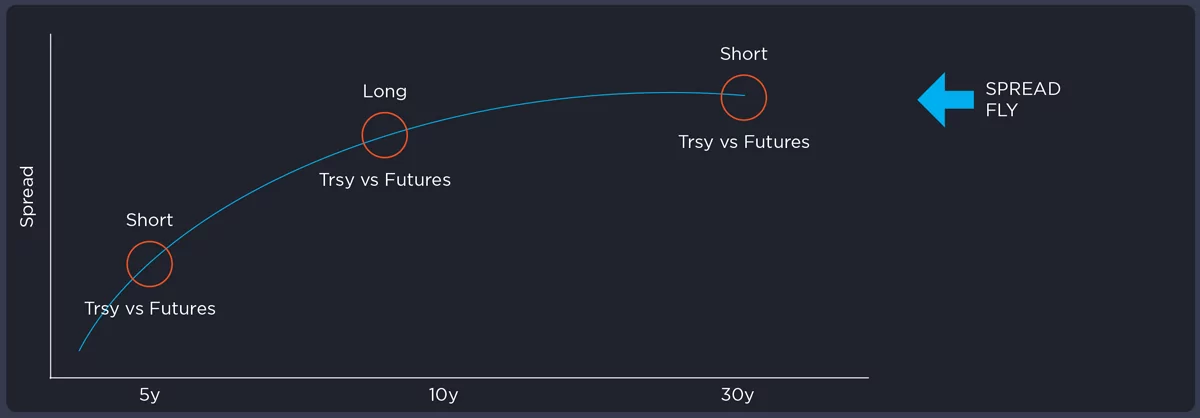

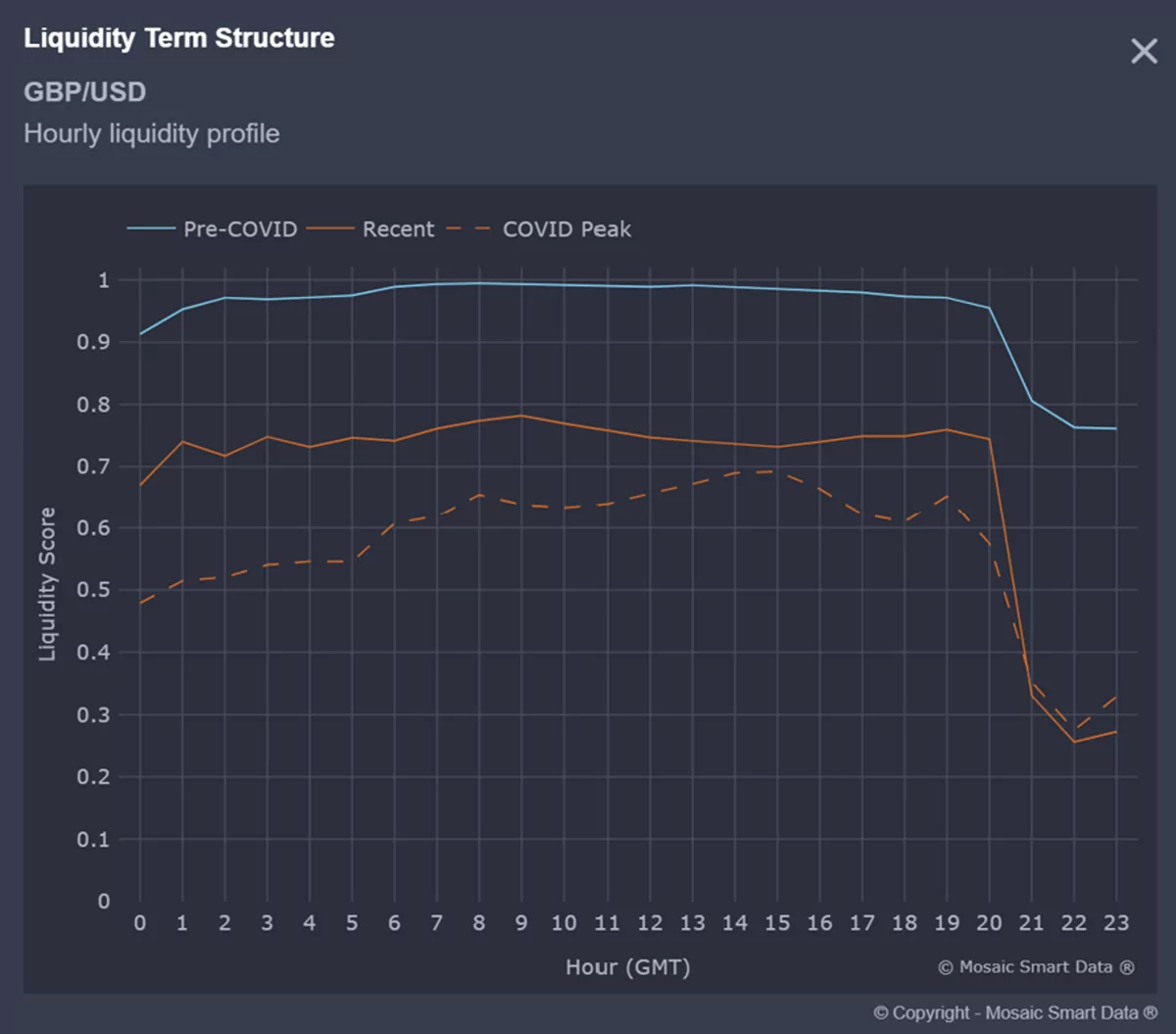

The following examples demonstrate how the MSX and MSX360 platforms can be used to analyse liquidity in difficult-to-price areas of the market, measure best execution, value securities and understand risk more effectively.