Steps Ahead

Deploying AI on the FICC sales desk: the time to act is now

Despite widespread challenges in the broader economic climate, trading divisions in many investment banks experienced significant growth and success in 2022 as they leveraged high levels of volatility and liquidity. This, of course, is a double-edged sword that sets high expectations from the business for the performance of the team in 2023 and beyond.

To protect and grow this market share, banks must set themselves up strategically for the future, and give their sales teams and traders the tools to enhance the level of service they can offer their clients. A recent ECB study confirmed this, finding that attracting and retaining market share is the central objective of most banks’ digital strategies.[1]

The key to this is leveraging often untapped pools of transaction data – but financial markets are awash with data and extracting useful insights at the right time is a huge challenge. However, when innovative AI-based tools are applied to this data, trading desks can access a highly accurate GPS for financial markets, guiding them to opportunity and action by identifying trends and anomalies in the market. According to the ECB, 60% of banks are already using AI, with more use cases in development.[2]

When deployed effectively, these tools enable traders to answer the following questions:

- What?: relevant insight into a point of interest in market activity.

- Why?: why this is a relevant point of interest to your work.

- What next?: specific, actionable suggestion for how to best take advantage of its insight.

At the heart of these questions is the premise of personalisation – in order to service clients more effectively, banks need to use AI in a way that allows them to understand and hone in on the specific needs of an individual.

In a world where we increasingly expect personalisation of digital services in our consumer lives – for example recommendations by Netflix on which movies we might enjoy – clients are also demanding greater personalisation in the enterprise space.

Whereas banks typically looked at their clients by segment and tailored the information they provided to them in this manner, they are now beginning to use AI built by firms with deep FICC industry knowledge to look at each client as their own segment, and hyper-personalising the insights and service they provide them. To achieve this, the majority (61%) of banks prefer to cooperate with external partners, mostly by buying in services and using consultants, according to the ECB.[3]

This is optimised with natural language generation technology, which delivers reports such as multi-asset morning briefings in a human tone of voice with easy-to-interpret analytics – the perfect combination of AI and human FICC expertise. The result for the bank is increased loyalty and greater share of mind amongst client.

These hyper personalised tools have a broad range of potential applications in the FICC markets. Some examples include:

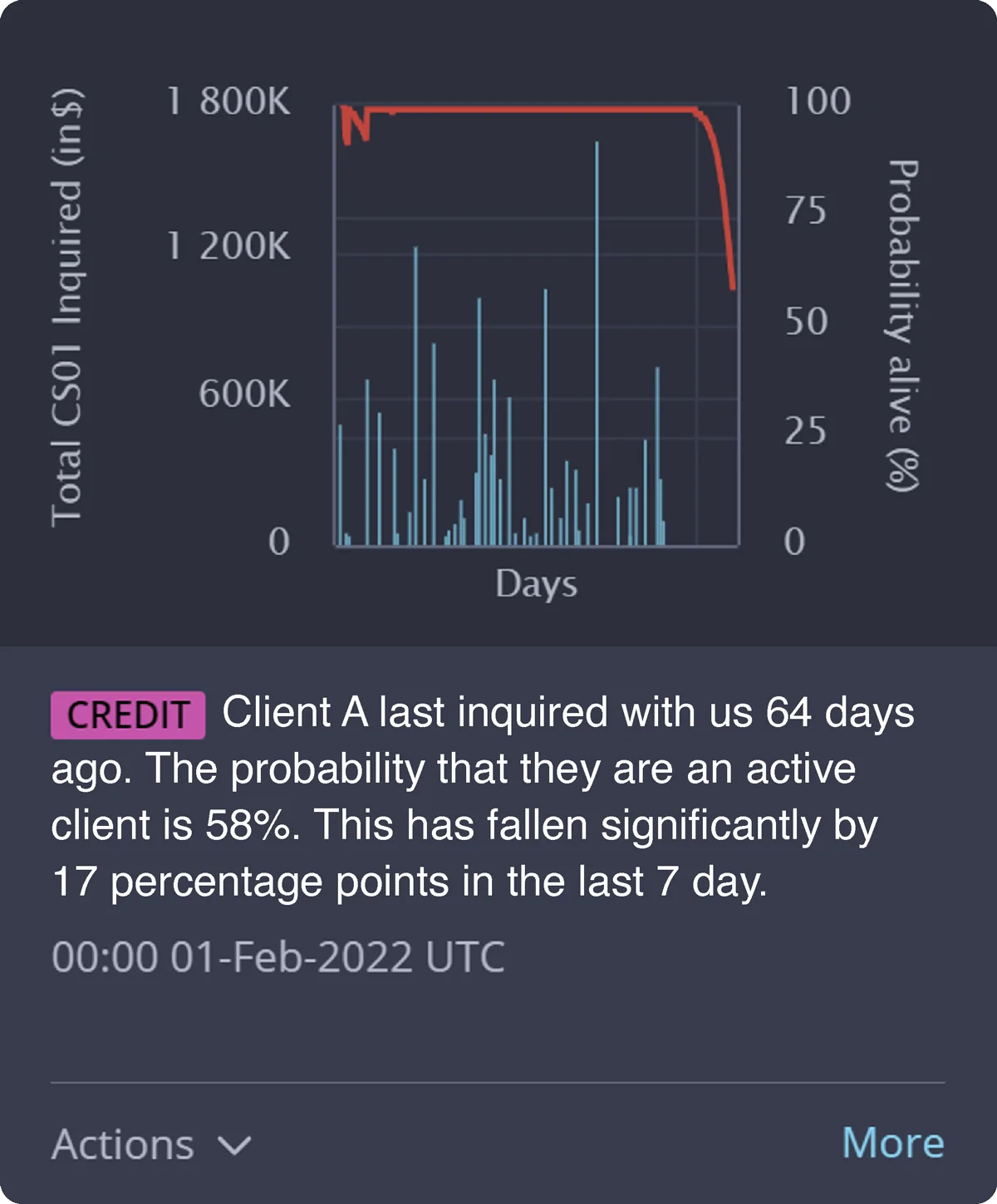

Insight into client defection and market share: allowing banks to see which clients might be about to defect, because they have scaled back their trading activity. If a client used to be active five times a day, but now hasn’t traded in over a month, the algorithm will detect this and alert the bank so they can work on saving the relationship and retaining their market share. After all, it’s more expensive to on-board a new client than it is to maintain an existing relationship.

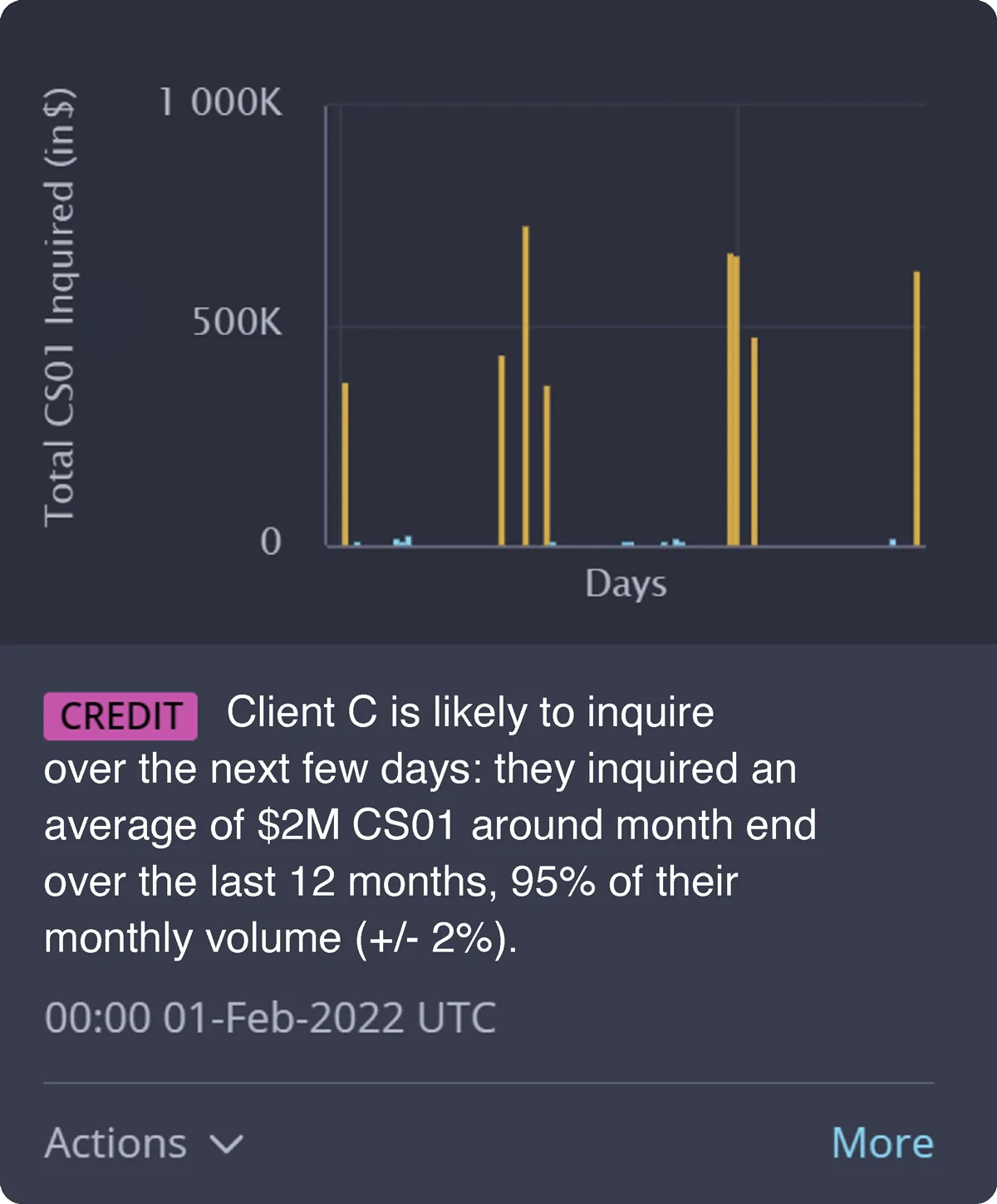

Seasonal flow recommendations: enabling banks to suggest appropriate opportunities to clients at exactly the right time. For example, if a client always trades at 2pm on a Thursday, the algorithm will alert the bank at 1pm to get in touch with the client. Or if a client does their index rebalancing on the 27th of every month, the algorithm will tell the bank on 26th of every month that client is about to become very active.

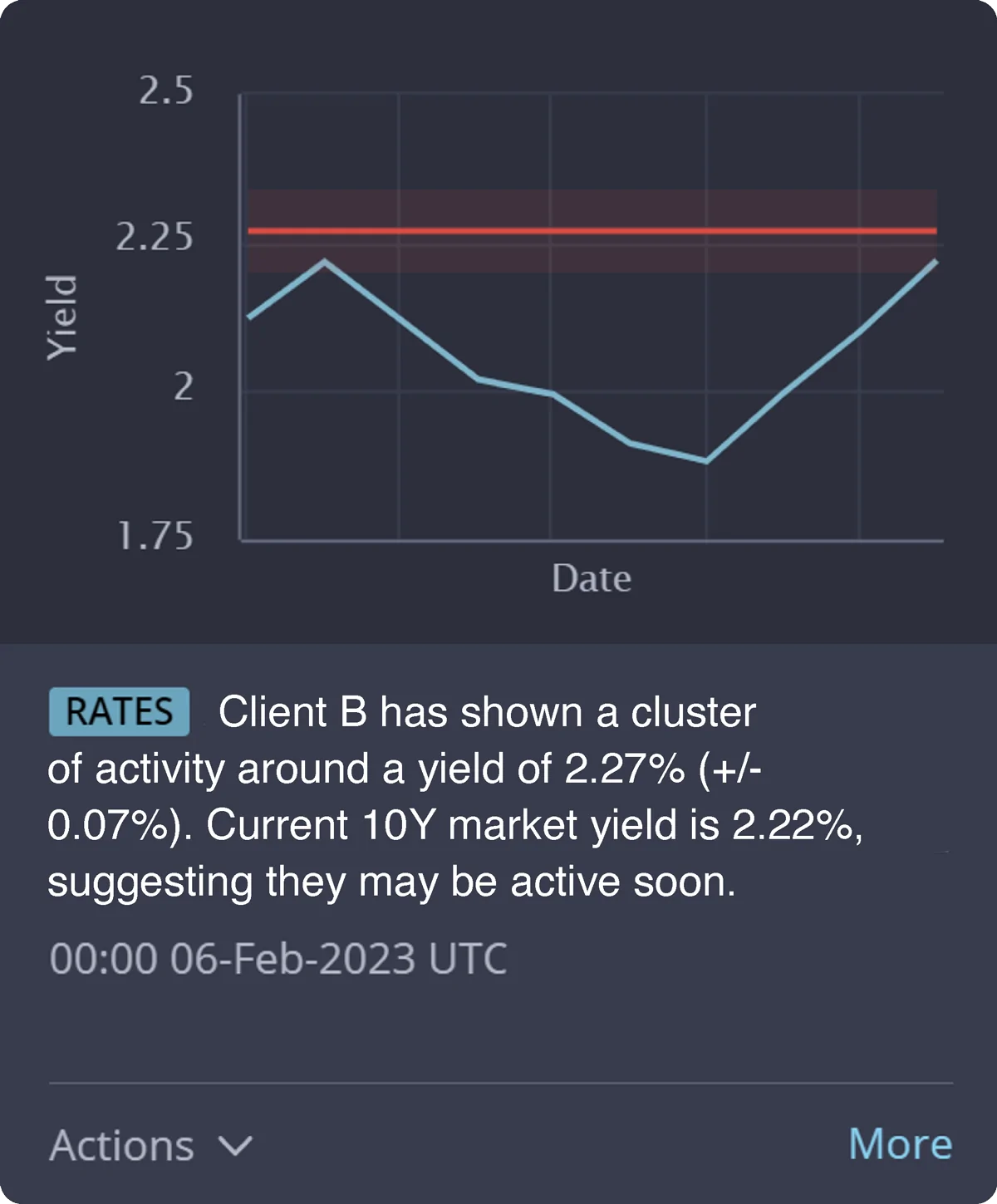

Level clustering: allowing a bank to see which clients are typically active if price or yields hit a certain level. Using an unsupervised machine learning algorithm, a bank can start to get a better picture of client activity around certain levels, for example during the Fed’s short term interest rate hikes. They can then offer an appropriate trading opportunity to clients.