Steps Ahead

Do more with less: Harnessing the power of AI and automation to create value in your FICC business

Current market conditions have created a turbulent period for banks across the globe. For those that have remained profitable, a laser-sharp focus on efficiency has become central to their businesses. Sales and trading teams must be equipped with tools to improve productivity and efficiency in a cost-effective manner against a backdrop of cost cutting and headcount slimming.

Specifically, client facing sales teams are challenged with bringing a higher and improving participation rate from their clients and trading teams are responsible for executing that flow. But this is no small feat when resources are scarce. Thankfully, AI and automated data analytics technology can change the ways in which FICC-trading investment banks can engage with their clients and help them do more with less.

Automation = profit

As McKinsey stated in a recent report, to capitalise on the opportunities of AI, investment banks “can make targeted investments that will drive productivity tailored to their unique client and product franchises. They will need to pay particular attention to choosing the right gen AI use cases, building capabilities that can scale, and managing the associated risks.”

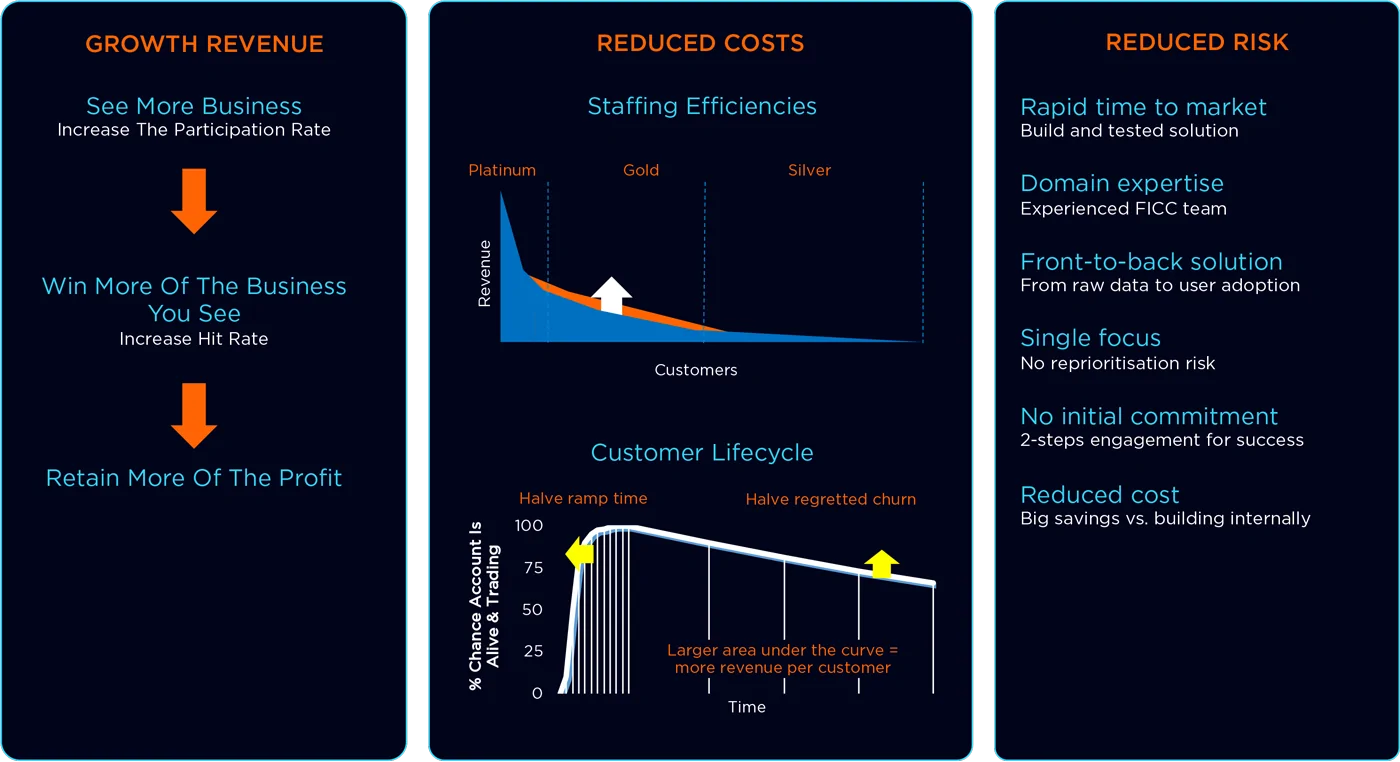

With the right AI-driven analytics platform in place, delivered by a specialised partner, banks can understand and measure the variables driving their objectives and create value across their FICC desks by seeing more business, winning more of the business they see, retaining more of the profit and reducing cost and risk.

Taking interest rate swaps as an example, how can an automated, AI-driven data analytics solution turn raw, unstructured data into an actionable insight and help FICC traders and salespeople do more with less?

The following diagram shows the automated process of a trade being booked on Mosaic, through to being transformed into a piece of actionable insight that can lead to client outreach:

Example use case: automating IRS flow