ING’s eFX spot flow increased by nearly 50%

© Copyright – ING

Data analytics was a laggard

Over the past two years ING has embarked on a digitisation journey across financial markets, with the aim of becoming a market leader in client experience. To achieve this goal they need data to be at the core of all decision-making and the foundation of their client offering.

Democratisation of data and analytics was a big gap that ING identified at the start of this journey. They had struggled to monitor their large volume of transactions and gain meaningful insight on client activity. The team’s data came from isolated and fragmented data sources, making it hard to develop a standardised approach and get a global view of client or product performance. This led to different conclusions being drawn, disagreements between sales and trading on how to improve and wasted effort on strategies that didn’t increase value and revenue.

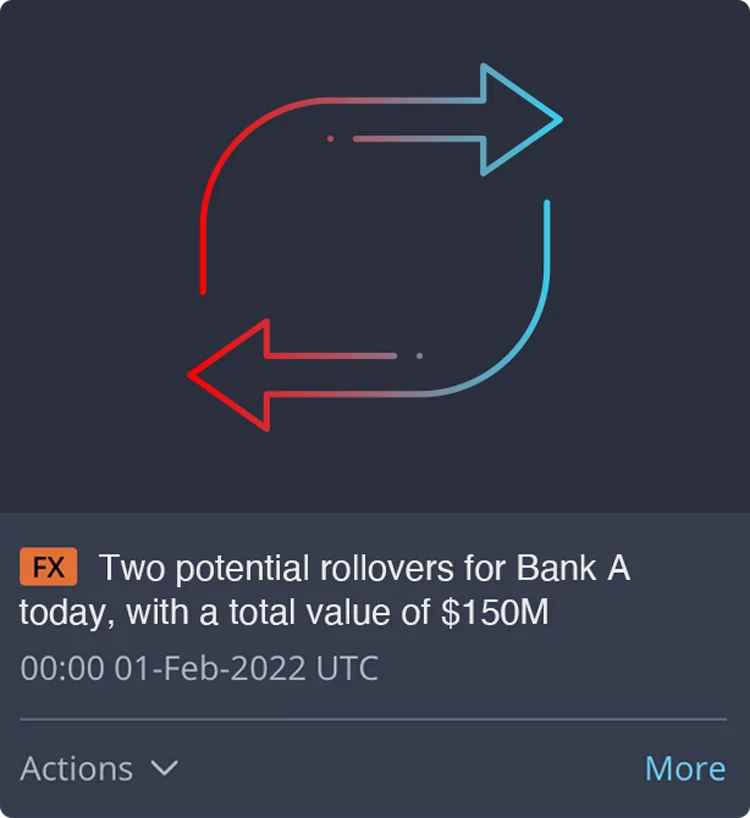

Individual salespeople and traders did not have access to holistic real-time data, instead relying on other teams to help them generate reports, which instantly became out of date. This means they could only ever react to changes in client behaviour well after they had occurred and perhaps miss opportunities altogether, such as an upcoming potential swap rollover. In other areas of the business they were able to respond to clients in seconds, but generating a report summarising trade activity with a client could take hours or even days. Keeping clients waiting for a report may lead them to make inaccurate assumptions about ING’s performance, including their hit rates, and incorrectly decide to move business away from ING to their competitors.

“We quickly decided to partner with Mosaic Smart Data, as a market leader they were moving faster than we could.”

Simon Bevan

Head of eFX Trading at ING

“Mosaic has become a key pillar of our digital transformation strategy.”

Stephane Malrait

Managing Director and Global Head of market structure and innovation for Financial Markets at ING

Myth: Banks find it easy to build sophisticated analytics

Most software solutions used to address these types of challenges are generic visualisation tools that require a lot of configuration and resources to work for capital markets.

“We made some progress building a solution in house, but soon realised the complexity of the build was far greater than we initially imagined.” Stephane Malrait

“We quickly decided to partner with Mosaic Smart Data, as a market leader they were moving faster than we could. Mosaic’s team of FICC specialists have experience in both the problem we had and the technology solution to solve it.” Simon Bevan

In the past, banks have found it challenging to implement a technology solution which incorporates all their transaction data into an external cloud from a compliance, security and legal perspective. By partnering with Mosaic, ING was able to leverage Mosaic’s experience working with other banks to understand what they needed to prepare. Whenever an issue arose, as they inevitably do, Mosaic proactively collaborated with ING to resolve it. The Mosaic platform was live at ING in just a few months – an aggressively short time frame for such an advanced platform.

ING can now proactively anticipate their client’s needs

“The true power of Mosaic comes when all sales and trading use it collectively to provide our clients with a market leading client experience.” Simon Bevan

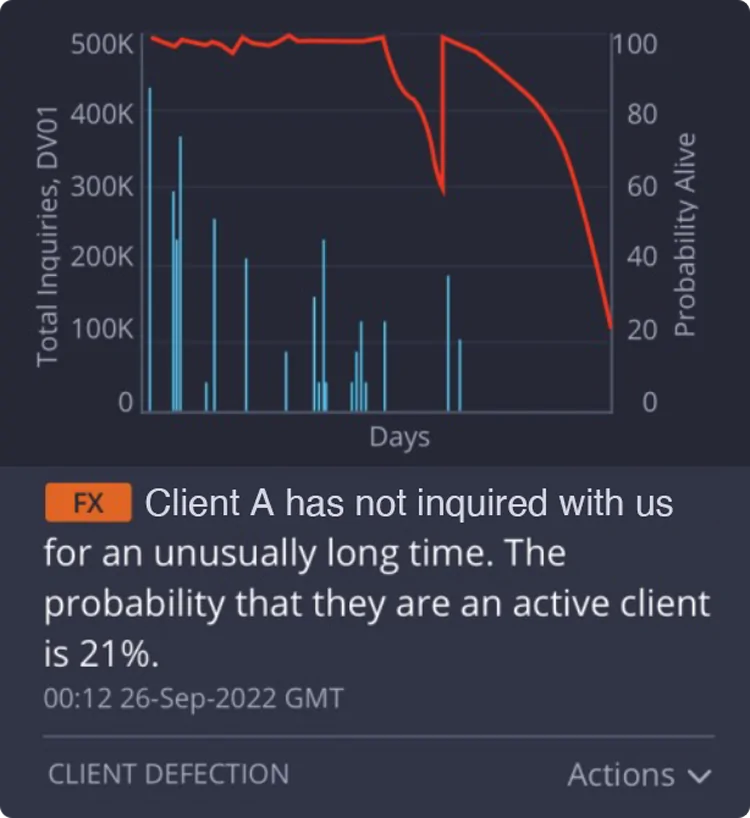

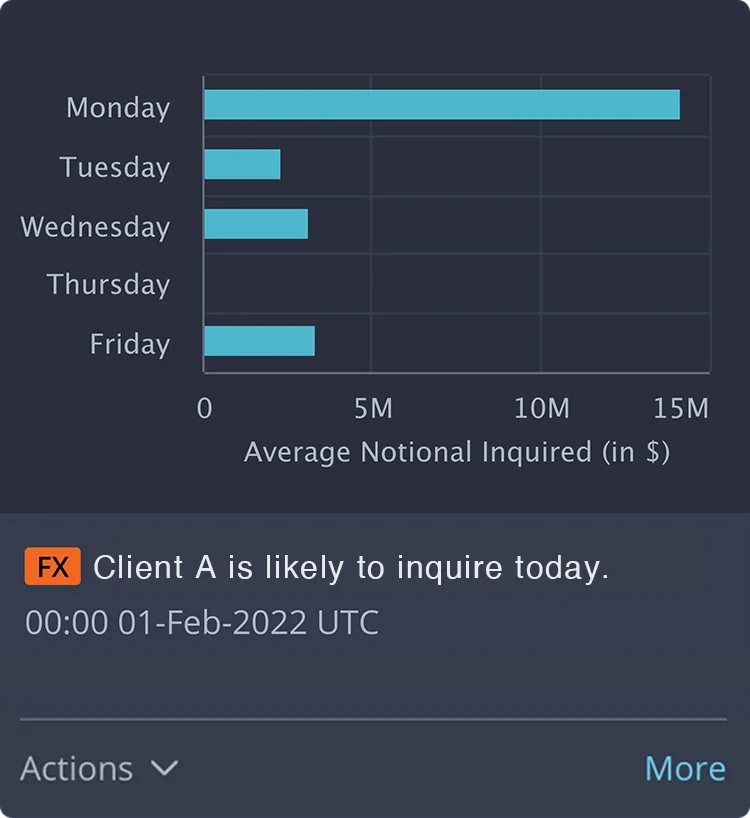

Salespeople often think they know their clients based on instincts alone and defer to analysts or quants to use technology to deliver deeper insight. Mosaic is designed for individual salespeople and traders, putting client and product activity insight directly into their hands. Without any technical knowledge, ING’s salespeople can generate trade ideas like an upcoming swap rollover, be alerted to potentially defecting clients and be truly proactive. Demonstrating such insight into their clients’ business helps to increase flows and revenue at scale across large portfolios of clients.

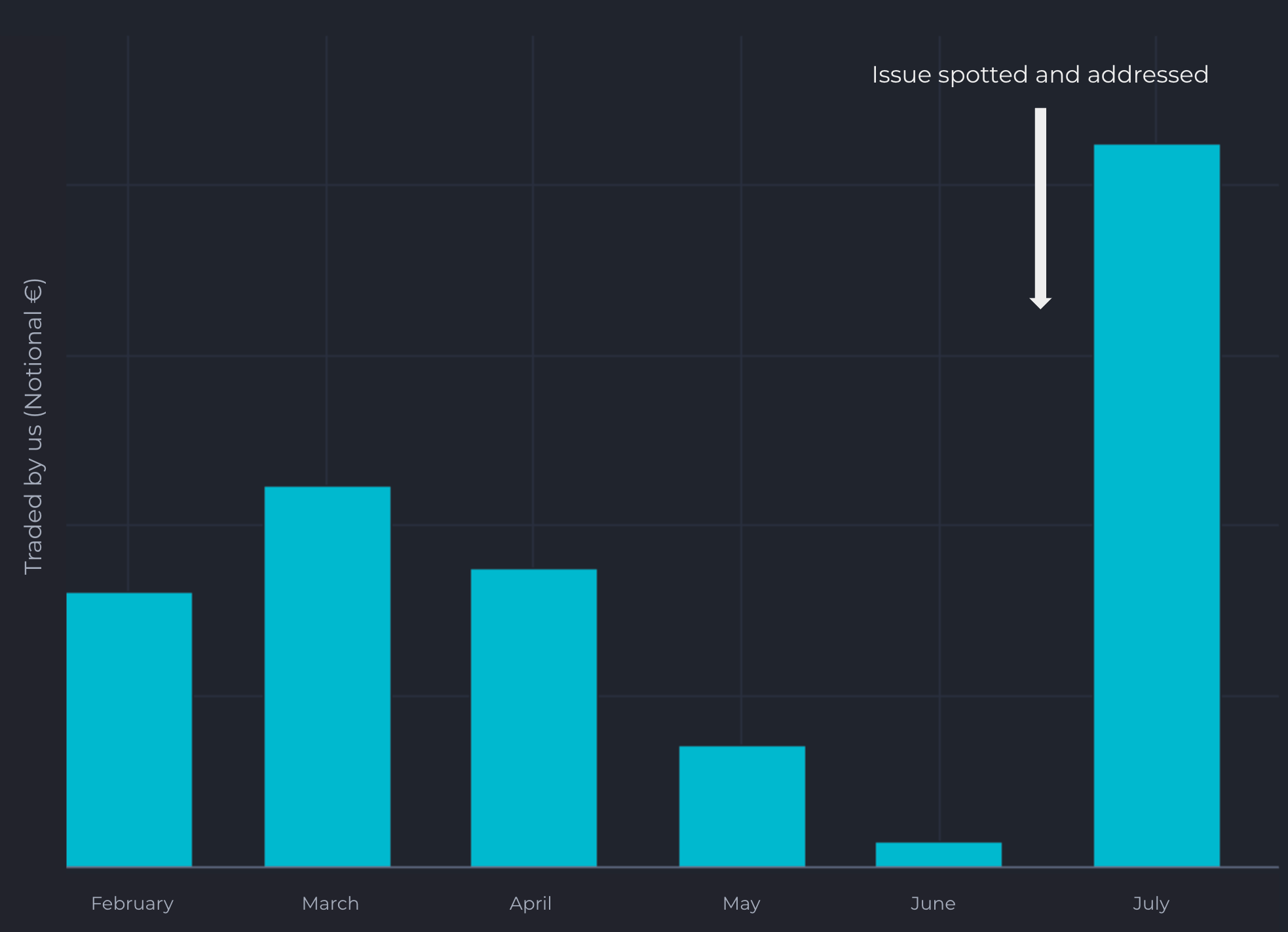

Mosaic’s insights enable ING to understand the root cause of a specific pattern so that they can decide on the right course of action. For example, the eFX team had noticed a drop in flow from April to June 2022. By slicing and dicing the data in Mosaic by client and currency pair over time they identified that a particular client had almost completely stopped trading a particular currency pair with ING. Armed with this information, they investigated how the bank offered that currency pair and urgently spoke with the client to address the issue. As a result, overall flow for the franchise rebounded and, with the remediation driven by Mosaic’s insights, that particular currency pair outperformed previous highs.

“We now have a deeper understanding of our clients and performance across products, from the high level to the most granular. We have grown our eFX spot franchise flow by nearly 50% in 2022.” Simon Bevan

“Mosaic has become a key pillar of our digital transformation strategy.” Stephane Malrait

“The true power of Mosaic comes when all sales and trading use it collectively to provide our clients with a market leading client experience.”

Simon Bevan

Ccy pair flow for the client peaked after intervention

© Copyright – ING