Fragmentation and complexity

While electronic trading platforms have gained popularity and market share over the years, voice trading continues to play a substantial role in FX swaps trading, especially for complex or large transactions where price negotiation and customisation are essential. The continued prevalence of voice trading in the FX swaps market underscores the importance of human interaction and relationships in the trading process, particularly for institutional clients who value personalised service, access to liquidity, and the ability to negotiate terms directly with counterparties. However, electronic trading platforms have been steadily gaining traction, driven by factors such as increased transparency, efficiency, and regulatory requirements. These venues are, however, largely limited to interdealer trading between banks and HFT traders that have prime brokers within the liquidity pool.

This fragmentation of trading across voice and multiple electronic venues creates a unique and complex data challenge for FX swaps traders. Insight into transaction data is particularly critical to success in this market, enabling traders to analyse the performance of swaps throughout the lifecycle, manage risks accordingly, and make appropriate trading recommendations to clients at the right time.

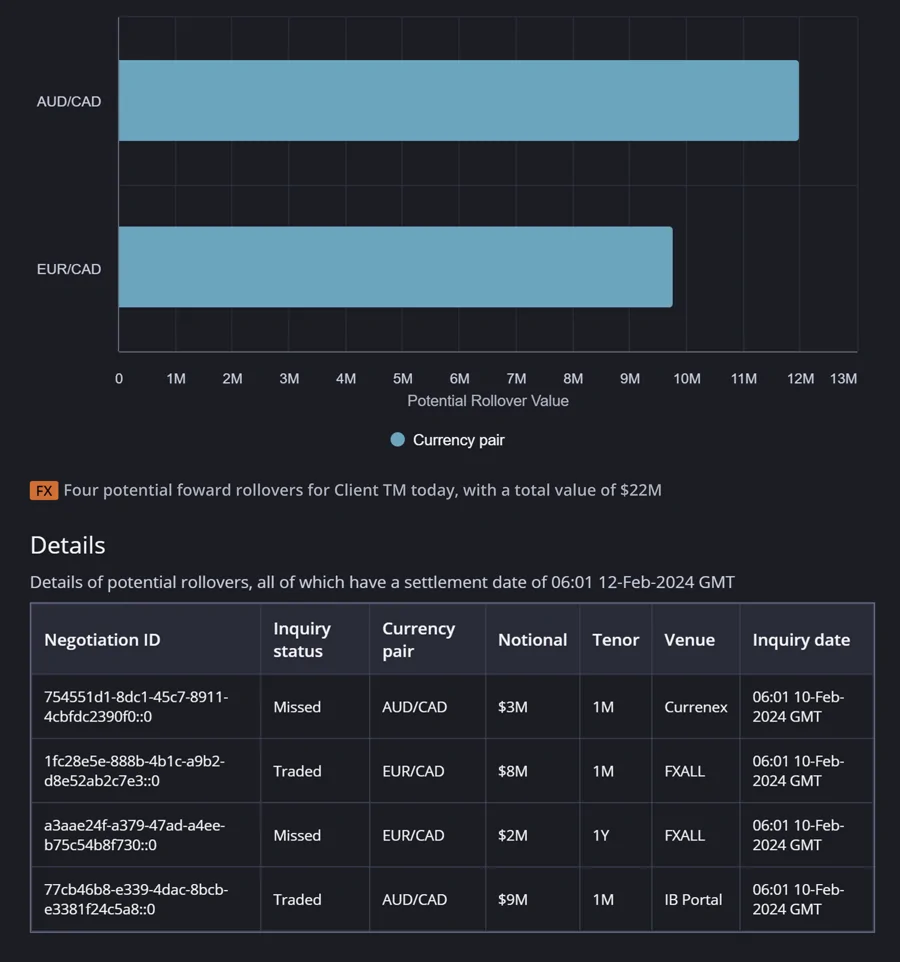

Hedges, based on FX Swaps, need rolling at some point. Two key essential requirements for this, especially around month-end, are:

- Getting alerted at the right time for upcoming rollovers (so that the desk can make a decision on whether to roll early)

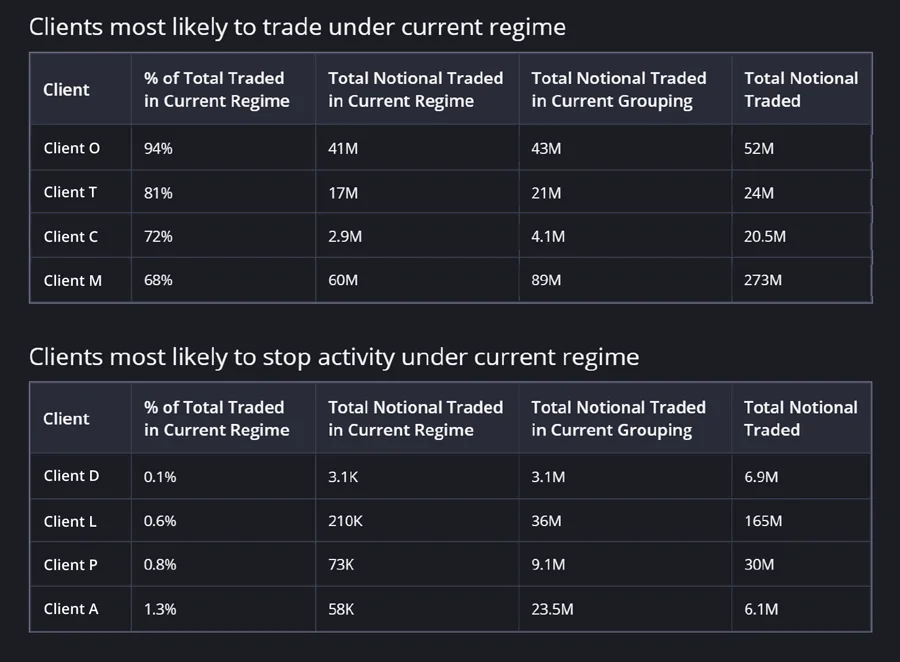

- Finding the right counterparty to trade

As an example, spreads on EUR/USD 3m forward rose from 0.33 pips on March 8th 2023 to 1.49 pips on March 21st 2023. This was attributed largely to the collapse of SVB and the announcement of the UBS and Credit Suisse merger. Having a reactive system which prompts for “early” action is absolutely vital around these periods of increased market stress.