Steps Ahead

Finding and protecting FICC liquidity

Q&A with Matthew Hodgson, CEO and Founder

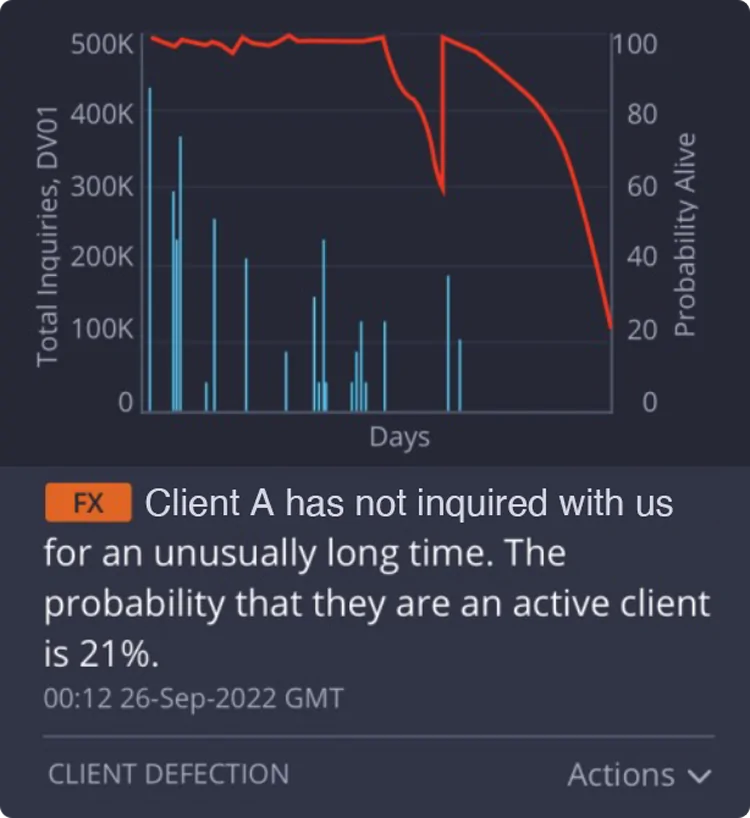

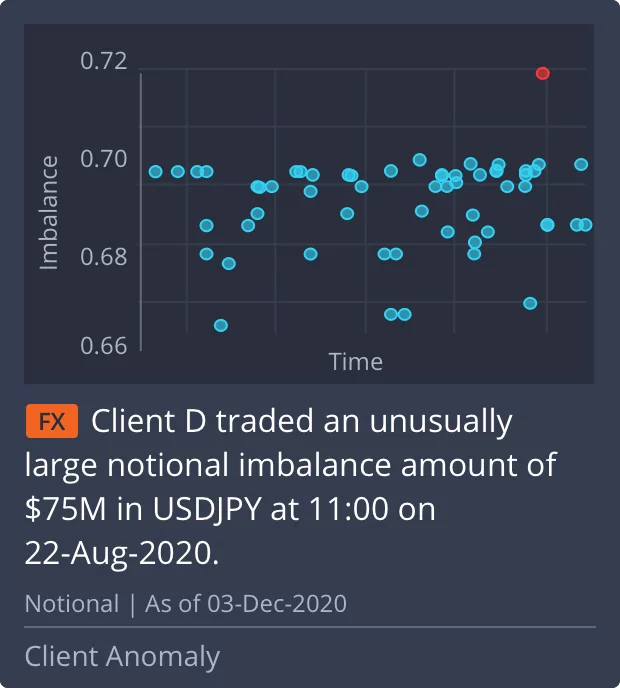

Amidst a backdrop of volatility, economic uncertainty and lower market activity in some asset classes, FICC market participants are struggling more than ever to source and protect liquidity. In addition, maximising the productivity of sales and trading teams has become top priority as cost saving and headcount reduction has become the norm.

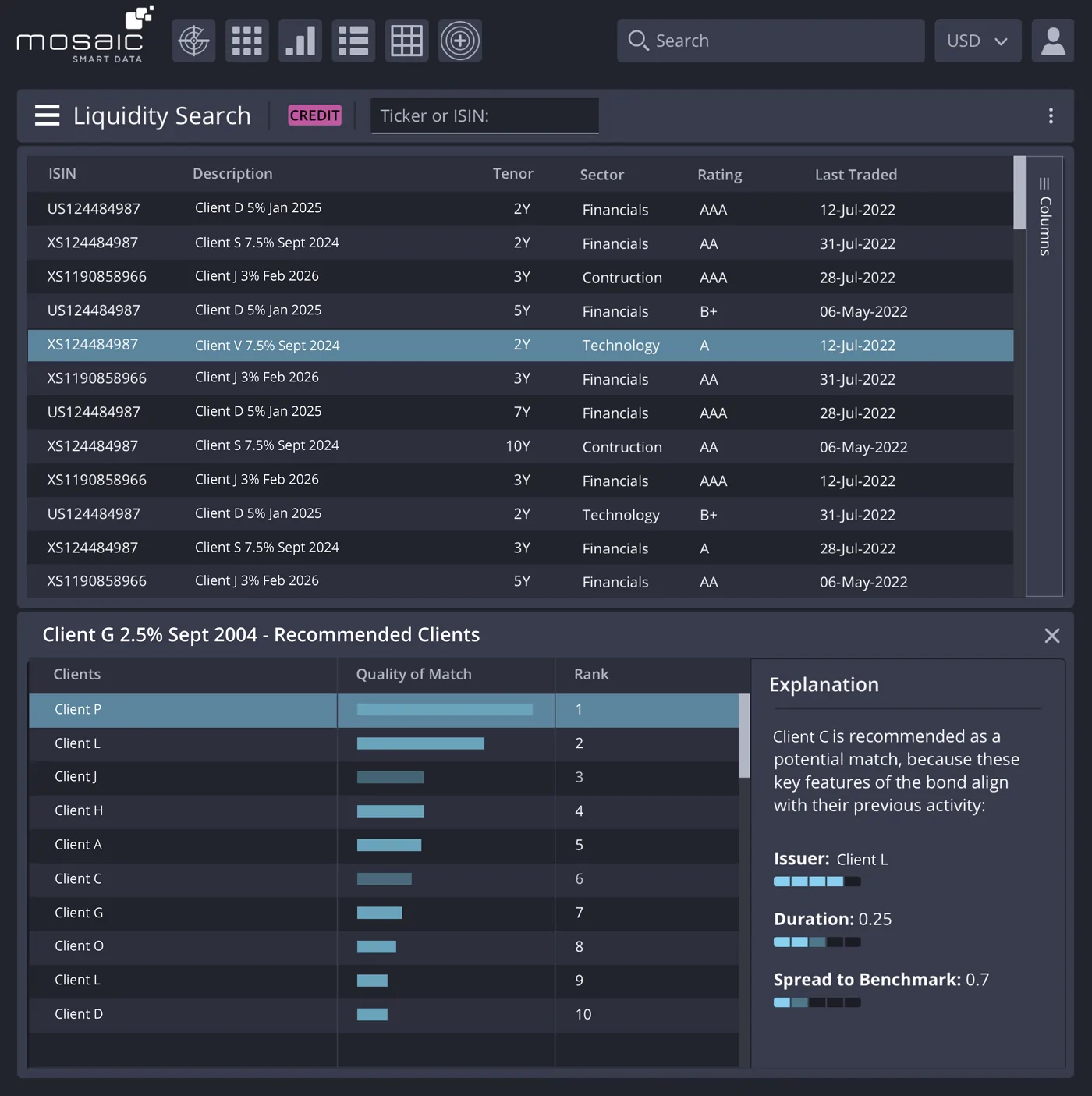

Finding the right inventory, at the right time and making the right recommendations to clients is critical to achieving a competitive advantage and retaining and growing market share. The key to this lies in deploying innovative AI-driven data analytics tools that enable banks to see where the herd is trading, where the opportunity for alpha is, and where they can find the specific instruments they want to trade. This is all automated and delivers huge time and cost savings for a bank – freeing up frontline staff to focus on client contact and activities.