Steps Ahead

AI-driven data analytics: the foundation for exceptional multi-asset client service

By: Matthew Hodgson, CEO & Founder

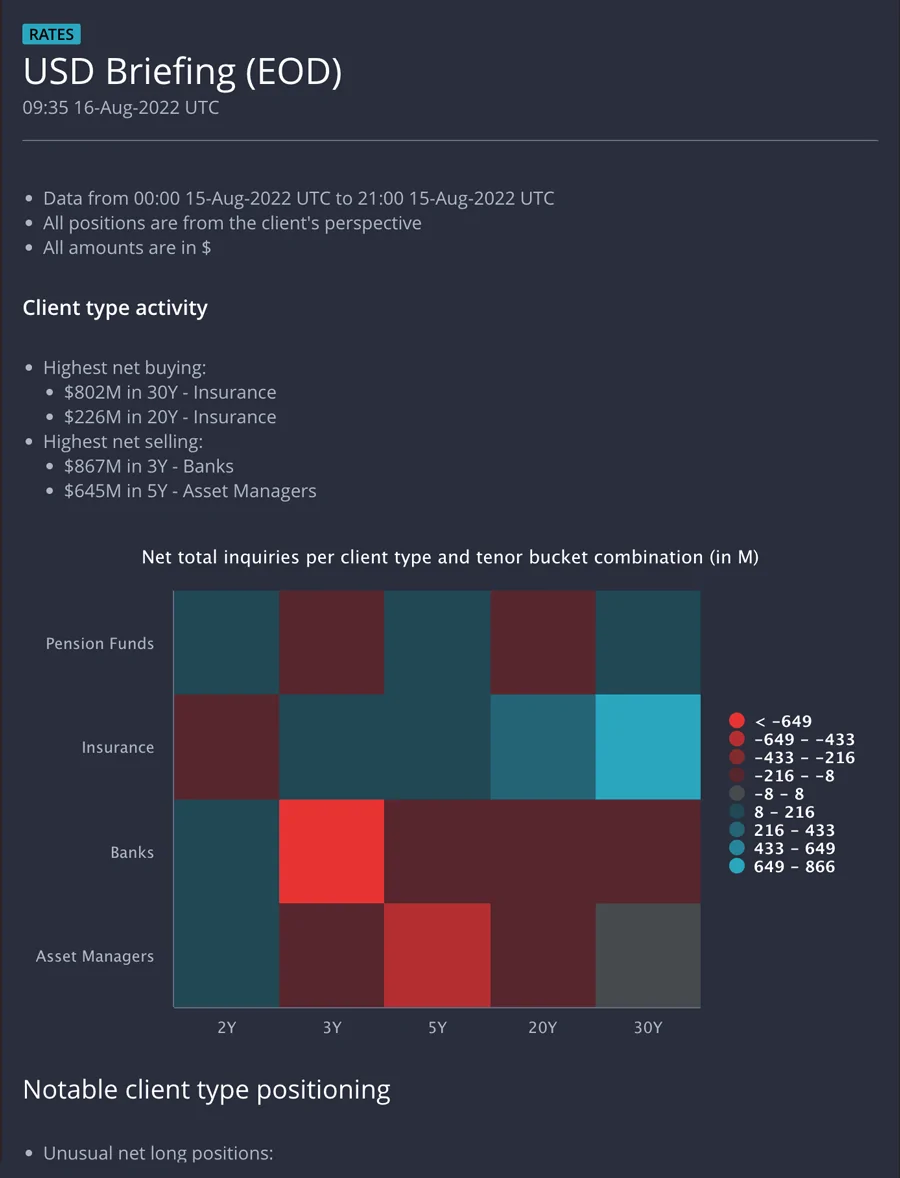

Investment banking is changing. Driven by relentless regulation, cost pressures, electronification and automation, sales and trading desks have undergone a revolution in recent years. Whereas previously, sales and traders would have been experts in specific asset classes, the modern trading desk has evolved to become more customer focused and truly multi-asset in capability and offering.

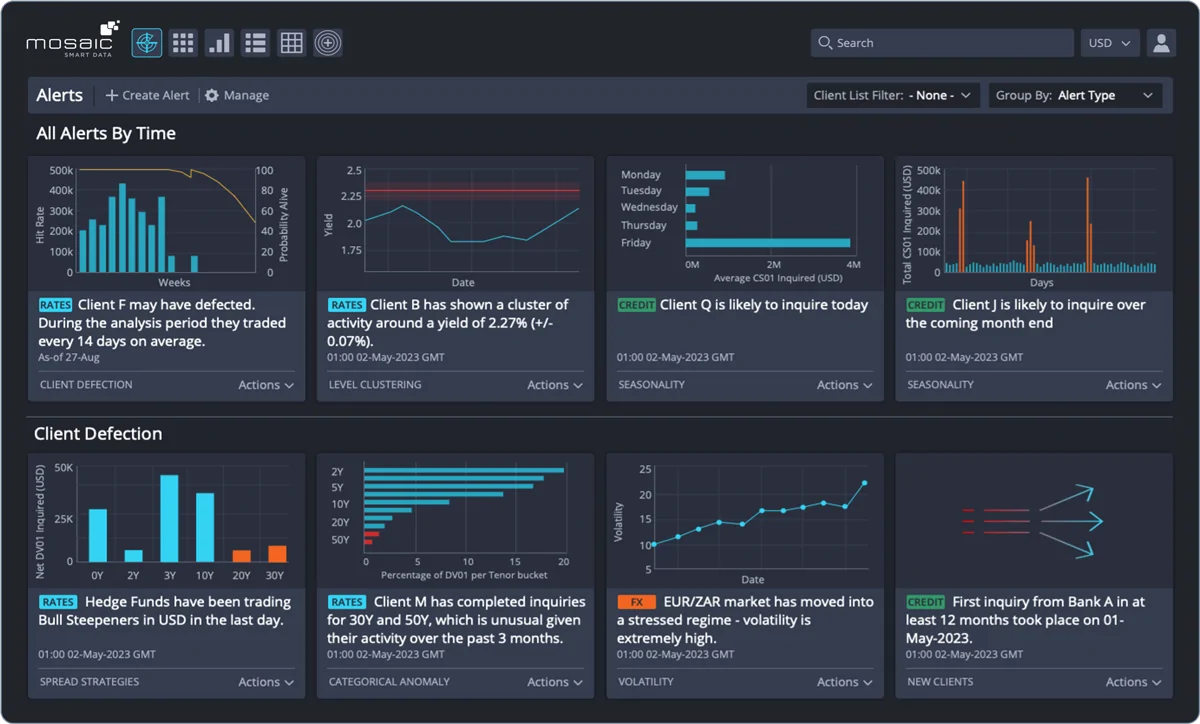

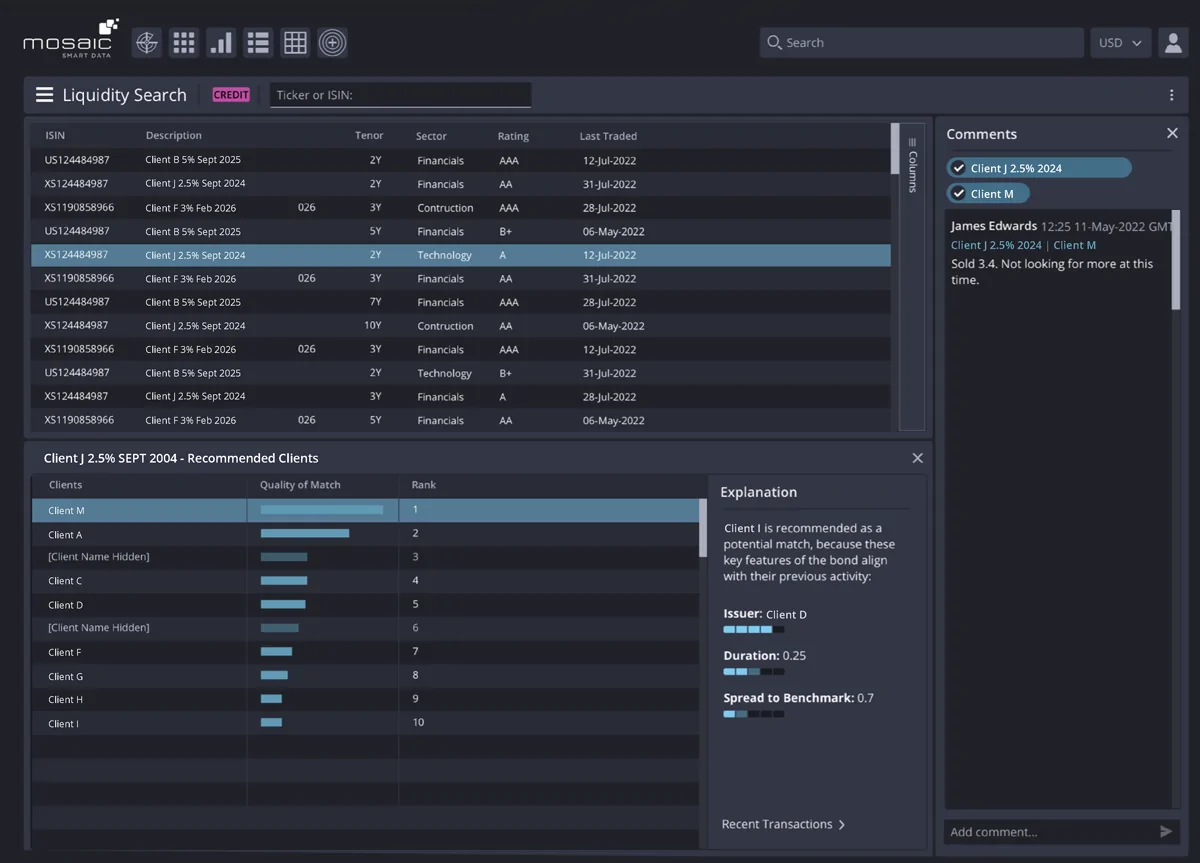

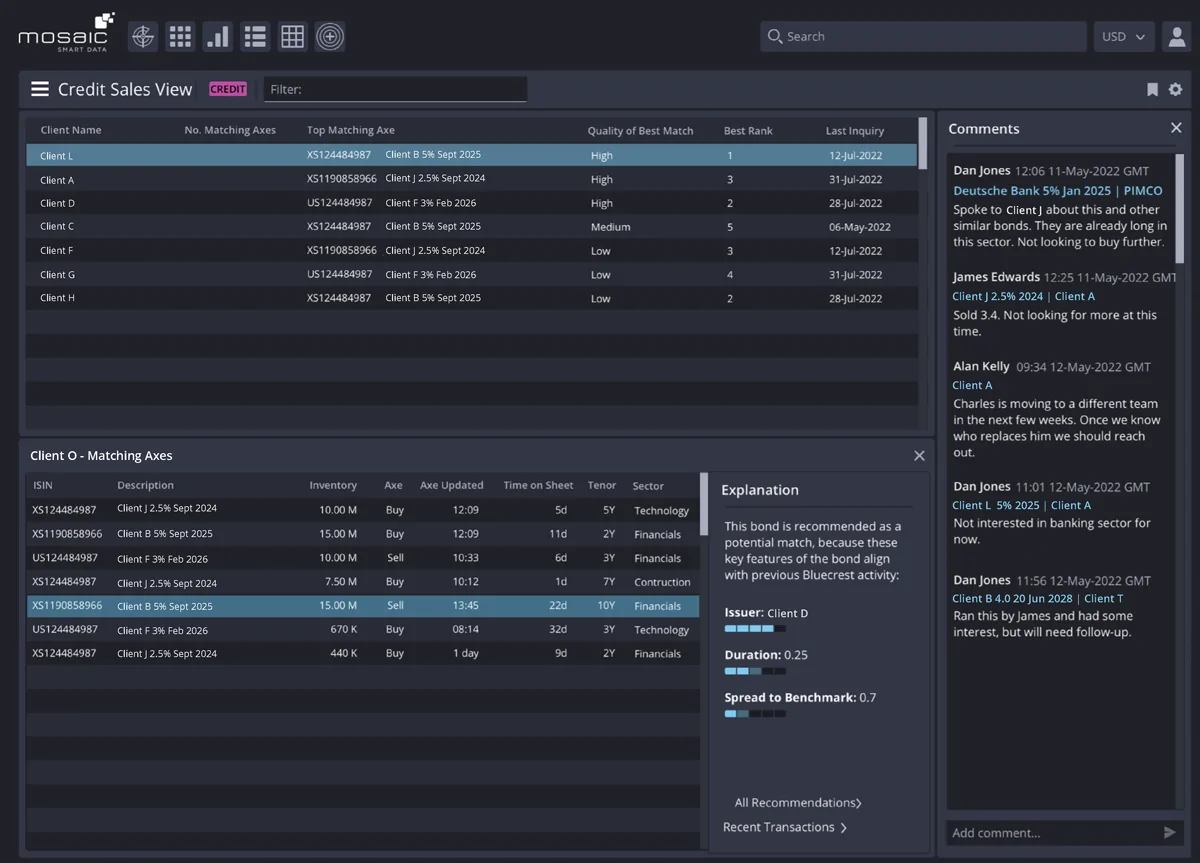

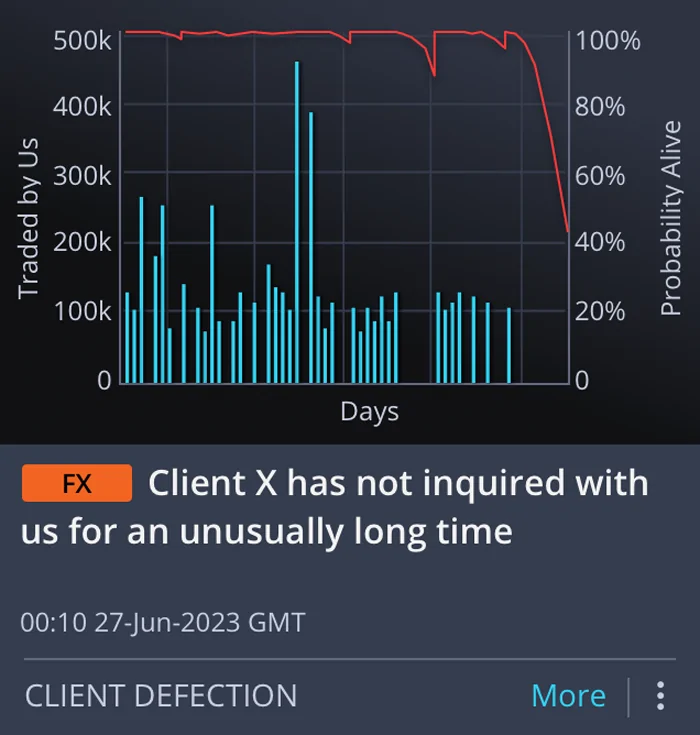

AI-driven multi-asset insights dashboard

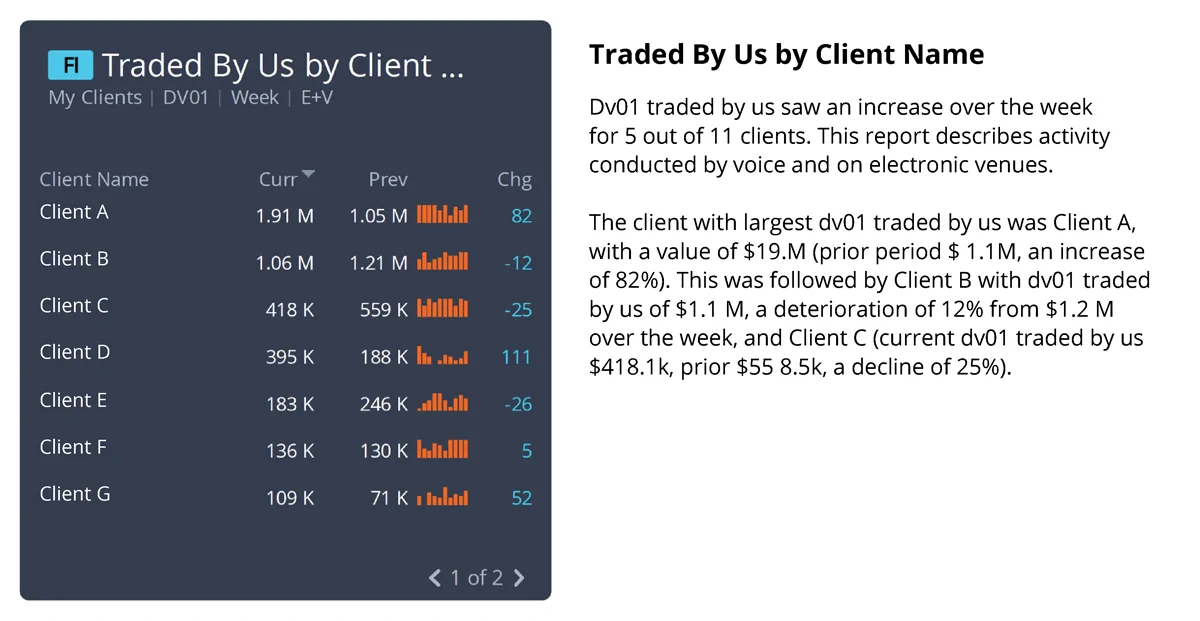

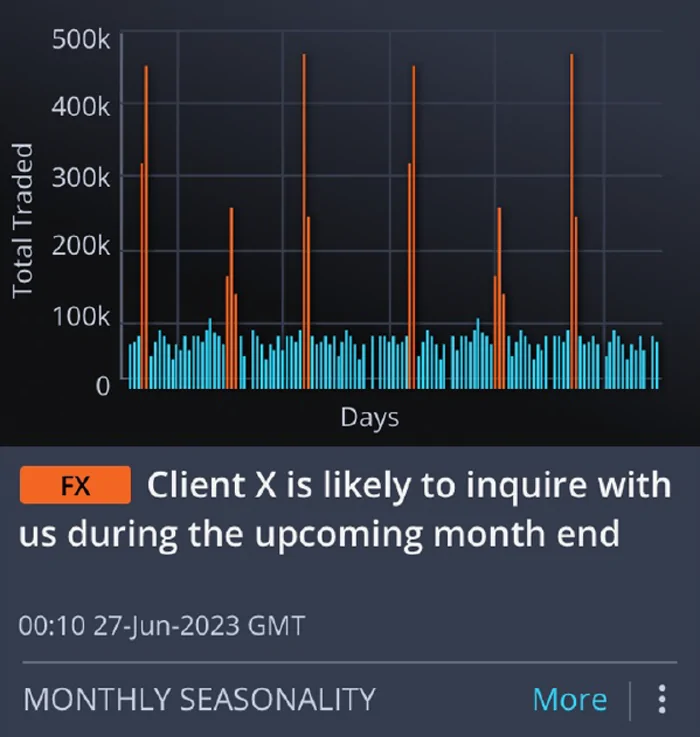

As a result, banks’ sales and trading staff are forced to do more with less. But how can a single person truly get under the skin of every market they cover and deliver the personalised level of service their customers expect?

The answer lies in cutting edge AI-driven data analytics – and adoption is picking up pace across the industry. A recent survey from The Economist Intelligence Unit found that 77% of bankers believe that the ability to unlock the value of AI will be the difference between the success or failure of banks, while in a 2021 McKinsey survey, 56% of respondents reported AI usage in at least one function of their organizations.