Steps Ahead

Mosaic Smart Data Bond Recommender: Utilize the power of AI to discover bond liquidity and turnover inventory

Corporate bond liquidity is fragmented and opaque – and for secondary dealers, the cost of holding a position is growing.

Particularly in the investment-grade and high-yield sectors, credit bonds have become less liquid. Many bonds trade infrequently, meaning it can be difficult to buy or sell large positions without affecting the price. When liquidity is low, the bid-ask spread widens, increasing transaction costs.

In addition, many financial institutions and brokers that facilitate bond trading are reducing their market-making activities or increasing the spreads on bonds they are willing to trade. As a result, the cost of transacting, including holding a position in these assets, becomes more expensive.

Regulatory requirements such as Basel III create additional cost pressures, mandating higher capital buffers and liquidity reserves. These requirements make holding credit bonds more costly for institutions, as they need to set aside more capital to meet regulatory standards, reducing their risk-taking capacity.

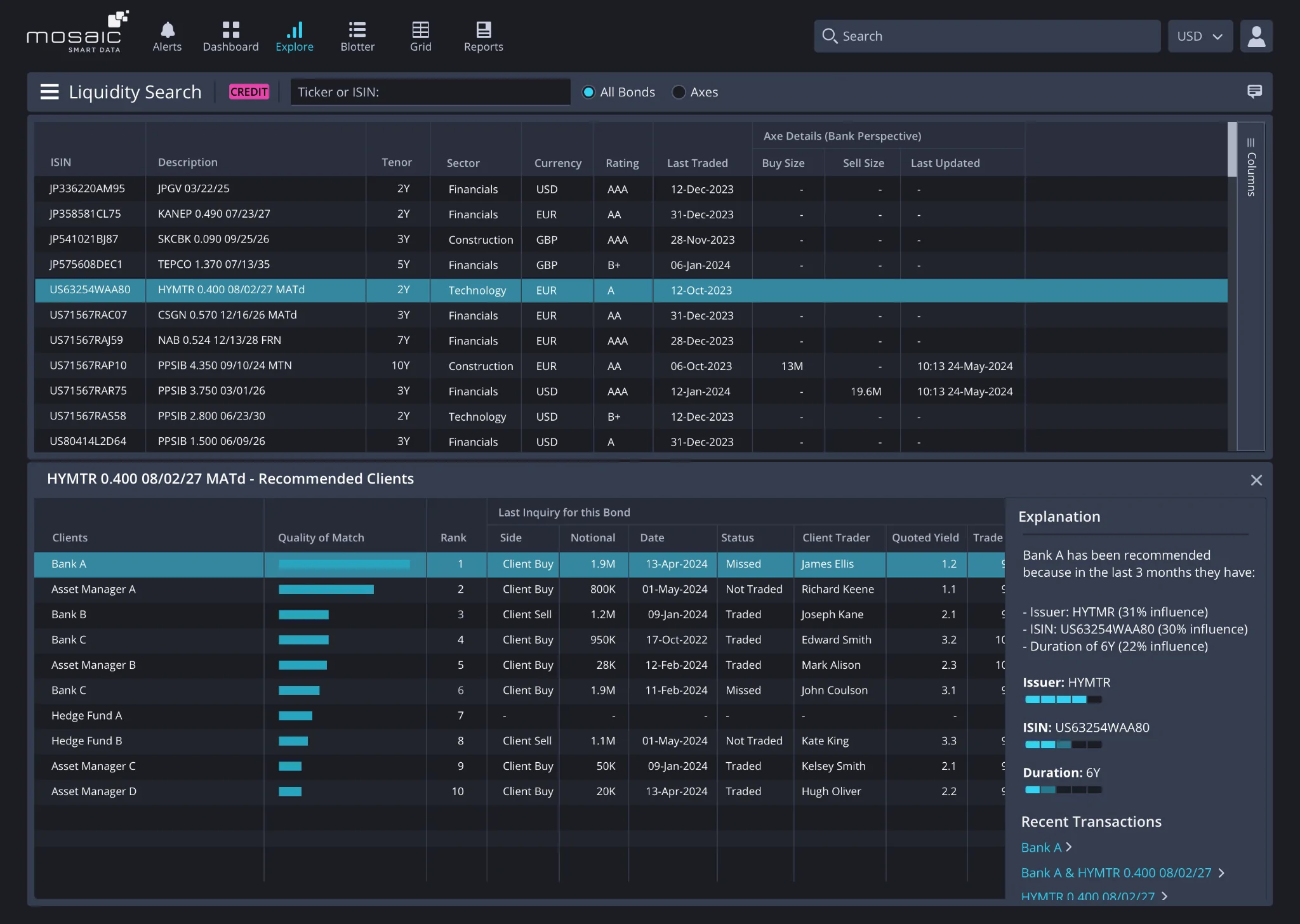

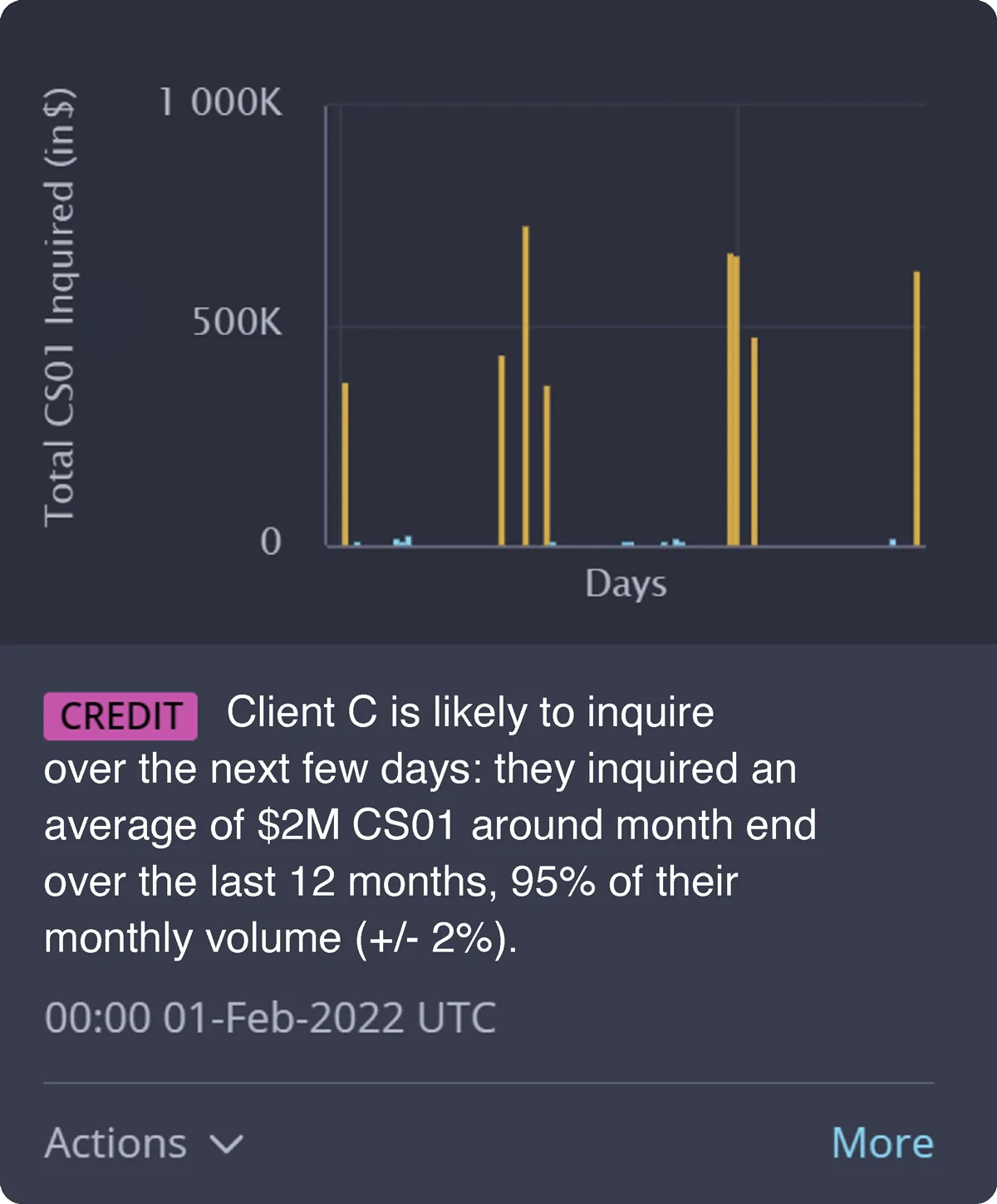

To be profitable it is imperative to optimize balance sheet utilization and the allocation of resources – financial, technical and human. Using advanced machine learning to analyze the historic activity of your clients, Mosaic Smart Data’s Bond Recommender allows you to pinpoint precisely the clients you need to target to trade your axes quickly, improving client engagement and trading performance.

The Bond Recommender tool leverages the Behavox ecosystem – underpinned by the Behavox LLM 2.0, custom built for capital markets – to allow for wider and richer recommendations and context.