“Mosaic Smart Data helps banks develop an internal view on client profitability by quantifying the P&L on an individual trade basis and assessing the real value of an individual client’s flow.”

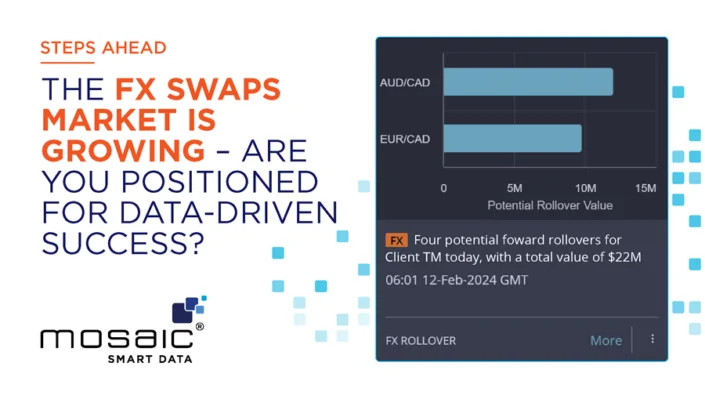

In trading, there are several digital opportunities. For example, Mosaic Smart Data looks to help sales and trading desks establish an external view of aggregat- ed electronic-venue performance to see how much of the overall market wallet they are capturing. Banks often pursue electronic market share for market share’s sake, which can lead to unprofitable performance. Client flows are increasingly fragmented across trading venues, which, with weakened client relationships, makes understanding client drivers difficult. By commingling electronic market data with diverse data sources and providing the event processing and visualiza- tion capabilities to analyze real-time and historical data, Mosaic Smart Data also helps banks develop an internal view on client profitability by quantifying the P&L on an individual trade basis and assessing the real value of an individual client’s flow.

Cognitive intelligence and machine learning are also likely to have a significant impact in the world of algorithmic trading, especially through mining new sources of data in new ways. The buy side may leverage big data to deploy new analytical trading tools, such as by using greater access to historical data and statistical analysis to make market predic- tions, or using machine-learning algorithms to discover clearer market entry and exit signals. Visualization tools and virtual-reality technol- ogy also offer new ways to glean meaningful insight from data. Dealers may try to antici- pate this new wave and empower the institu- tional buy side with trading tools that provide more parity with their own trading systems. They may also look to aggregate unstructured data sources within their own organizations, such as internal social network and enquiry systems, into a single, structured platform that can be mined by machine-learning tools for new insights on pricing and client activity.

Community-based investing is another key theme for many financial-market start-ups, with various models allowing individuals to mirror the real trades of successful or profes- sional investors. Dealers might look to antici- pate this trend by partnering with major social-media giants to offer trade execution as well as ongoing market commentary. Some are already looking to use big data to provide interactive digital tools that create value by generating answers to client- or product-spe- cific questions that could never before be an- swered in a meaningful way—a Siri for finan- cial-market investing, if you will.

Just as dealers have supplied institutional in- vestors with algorithmic tools to help them disguise their intentions in the equities mar- ket, they may opt to do the same with the next generation of trading tools. The buy side

is pushing for standardization of securities and is looking for new networks in which to take advantage of better access to liquidity. They may want to be less reliant on banks and to use tools that enable them to act more independently. It may seem counterintuitive to develop tools that enable a more indepen- dent buy side, but by embracing change in- stead of denying it, the sell side could actual- ly enhance client relationships.