Industry experts Jack Jeffery, Roger Barton and Don McClumpha, Senior Advisors to Mosaic Smart Data®, in conversation on the evolving regulatory environment, the challenges in meeting the increased demands being faced by players within Fixed Income and how dedicated technology can be effectively applied.

HOW IS REGULATION AFFECTING SELL-SIDE BANKS IN THE FICC MARKET?

- Regulation is increasing transparency across FICC markets. Beyond this, the increasingly critical roles of electronic trading and market surveillance are acting as twin drivers of reform. Together, these factors continue to place fresh emphasis on banks’ abilities to conduct effective trade auditing and automated reporting

- This will result in increasing levels of pre-trade and post-trade transparency provided by market participants and place exacting requirements on the way in which customer activity data is captured, analysed and reported

- The introduction of new legislation also increases operational costs in meeting these exacting requirements and is placing real pressure on the sell-side who have seen their FICC revenues decline in recent years

- Regulation, including increased capital charges, is also increasing the cost of warehousing risk, impacting banks’ capacity to act as market makers and forcing them to focus on their most profitable clients

- MIFID II, with implementation planned for January 2017, will further increase price transparency and lead to tighter bid-offer spreads, further pressure on profitability and the continued need to increase balance sheet turnover

- As a result of these forces, the playing-field for sell-side sales and trading teams has permanently changed and banks need to find new ways to increase their productivity and profitability, and at the same time, adhere to current regulatory requirements, whilst preparing for the addition of new ones

- However, these types of regulatory obligations can deliver opportunities for banks to derive competitive advantage by deploying pre and post-trade tools to build greater revenue, productivity and market share. Mosaic provides a solution to today’s regulatory reality

HOW CAN TECHNOLOGY BE BEST APPLIED?

- Most participants understand what is needed but, the perennial debate is, ‘do we build it or do we buy it?’

- What we do know is that the trading environment for bonds, derivatives and ETFs will look very different in Europe from January 2017

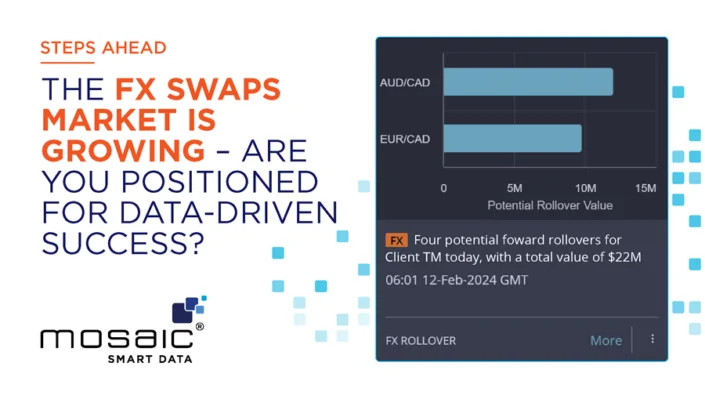

- In a data-saturated, fragmented trading environment, the only feasible solution to overcome this raft of new regulations and market challenges is through a deeper and timelier understanding of client and business drivers

- Mosaic’s MSX™ platform aggregates multiple sources of transaction data into a single point of consolidation, enabling banks to build a comprehensive view of client trading activity

- Analysis of aggregated, standardised data of client trading patterns provides the necessary information to create comprehensive audit trails required by regulatory bodies. It also allows sell-side firms to quickly adapt to the new regulatory landscape relating to transparency, reporting and monitoring of customer activity

HOW DOES MOSAIC HELP THESE INSTITUTIONS TO MEET COMPLIANCE REQUIREMENTS?

- The European Securities and Markets Authority (ESMA) has proposed that bids, offers and depth of market must be published by RFQ-based venues, with the aim of increasing pre-trade transparency as well as an ability to prove best execution

- Mosaic has been designed to help banks address this new, constantly evolving regulatory landscape. It aggregates multiple sources of electronic trade flow and, in doing so, enhances oversight internally and for regulatory bodies. The MSX™ platform provides detailed analysis of and insight into client trading flows around core metrics, which include price, product, instrument & venue (and a host of critical parameters) to efficiently and effectively monitor trading behaviour

- To help ensure compliance, the MSX™ platform captures and analyses all relevant data to enhance audit trails and reporting can be automatically created

- This allows sell-side firms to not only meet the new regulatory requirements but also to adapt their activities to optimise their effectiveness within the new regulatory framework

HOW DOES MOSAIC’S MSX™ PLATFORM ENABLE BANKS TO MONITOR CLIENT TRADING BEHAVIOUR MORE EFFECTIVELY?

- The primary purpose of Mosaic’s MSX™ platform is to improve productivity of FICC sell-side players (sales, trading, management and compliance) by providing the real-time information necessary for users to become more targeted in their understanding of client trading behaviour

- This includes views on historic and real-time monitoring for diagnostic purposes and also descriptive client activity to drive the right business decisions

- A significant additional benefit is that by capturing, standardising and analysing the data from electronic venues, the increasing regulatory requirements can be met

- From a technology perspective, it’s about developing agile trading technology frameworks that integrate with existing systems, yet also provide flexibility and scope for adaptation.

- The MSX™ platform has been purposely built on agile and robust technology that provides scope for integration with new technologies as they become available

SPEED & DATA ARE THE NEW CURRENCIES

- All banks hold an overwhelming and increasing volume of data. The trick is to have it all in one place in a useable, standarised and easily accessible format

- Banks are under unprecedented pressure to evolve their people and processes to remain competitive. Gaining control of their data will allow these institutions to focus on generating the highest returns

- This can be achieved through the provision of intuitive, easy-to-use tools and by empowering sell-side players with automated alerts to direct the right action at the right time

- Speed is the new currency in this highly regulated and fragmented trading landscape and, by shielding employees from vast analytical complexities, the dual benefit of productivity and regulatory compliance can be met in parallel