Steps Ahead

Optimising FX P&L: How Smart is Your Data?

By Matthew Hodgson, CEO and founder of Mosaic Smart Data and Jack Jeffery – Chairman of Mosaic Smart Data

It’s little secret that FX businesses in many banks are struggling for profitability and adequate ROC. Coupling this with increasing regulatory data management requirements further darkens the picture. However, as Matthew Hodgson – Founder & CEO of Mosaic Smart Data and Jack Jeffery – Chairman of Mosaic Smart Data explain, there is actually a major opportunity implicit in this situation. If done well, compliance with data regulation can also be used to boost an FX business’s profitability and automation.

Regulation: drawing opportunity from necessity

The past few years have seen a raft of legislation, such as PSD2 and GDPR, that directly affects the banking industry. A significant proportion of this regulation includes regulatory requirements specific to data, with one example being the BCBS 239 standard within Basel IV, which requires banks to meet specific standards relating to risk data aggregation. However, despite the deadline of January 2019, progress has been slow – a point that has not been lost on regulators. The ECB’s May 2018 Thematic Review made clear its displeasure1, while the BIS has encouraged national supervisors to apply more stringent measures, such as capital add-ons and restrictions on business activities, to banks that fail to comply2.

Compliance with this (and other) data-related regulation is clearly not optional. However, if undertaken in the right way, it is also possible to derive major business benefits at the same time. This applies across the banking enterprise in general, but is particularly relevant in FX businesses, where extreme cost pressure is now the norm and profitability is depressed – both of which are driving a need for automation.

The critical point is how data is managed and stored. An ideal implementation is one where diverse data classes and formats become completely clean, consistent, normalised and enriched. In addition, this capability has to be channel-agnostic and apply (among others) across electronic, voice, direct, prime broking, retail and corporate activities.

Apart from achieving regulatory compliance, this opens the door to converting clean big data into smart data: in this case, smaller information subsets that are both valuable and actionable. This data will then be accessible from multiple perspectives, such as individual client activity by pair, by channel, by request, by deal, by instrument, by hit rate and so on.

Real time, multi-source

A smart data solution that can deliver the necessary data consistency and granularity for existing information in one consolidated platform is clearly a major step forward. However, it also needs to be able to do this in real time, while simultaneously enriching in-house information by consistently integrating external data sources.

At the most basic level, this can immediately transform the productivity of existing analysis. A common complaint among data scientists is that they spend most of their time (approximately 80% according to some surveys3) in data wrangling rather than actual productive analysis. If all FX transaction data is now accessible by data scientists and quants in a single consistent format, then that version of the 80/20 rule should be more than reversible. But the benefits of consistent data apply universally across the business, not just to data scientists and quants. If the solution that transforms the data also includes actionable reporting and rich analytics, then the quality and productivity of analysis throughout the FX business in general also rises – as should profitability.

Actionable data

A common misconception here is “pretty pictures”: the assumption that reporting is merely one-dimensional decorative data visualisation, rather than a real P&L driver. Reporting is also commonly perceived as static and historic, not real time and immediately actionable. Given the right smart data solution, both these assumptions are completely incorrect.

Firstly, with a solution that transforms data so that it is both normalised and granular, reports are never “canned”, they are flexible in multiple dimensions. The only practical limitation is the user’s imagination, because the data can be infinitely sliced and combined as required. Secondly, a solution that is aggregating real time data with existing historic data and making it highly accessible is by definition dynamic, not static.

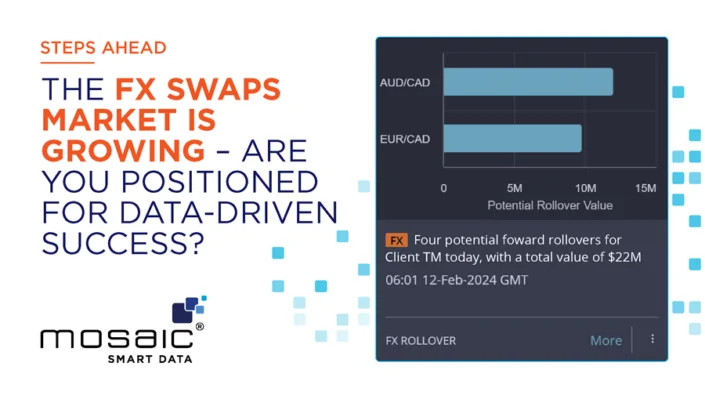

The net result is that business decisions can also be made and acted upon in real time. For example, an alert could be set on client behaviour, such as the average hit rate in a particular pair, in a specific time zone, over a certain time horizon. If the hit rate drops below a configurable threshold, an alert appears. The user might then pull up a broader report on the client relationship to put this information in context. An informed decision could then be taken on whether a tightening in pricing for the trigger conditions was justified in order to improve the hit rate in that pair. Instant access to comprehensive data also makes drilling down to a trade by trade level and conducting detailed pre/post transaction scrutiny trivial. Therefore, detecting other anomalies – such as toxic flow – and responding to them appropriately becomes equally trivial.

These are just two examples. In practice, this same degree of real time analysis could be applied across the entire FX business for every counterparty. The bottom line is that the business is able to respond to challenges and changes iteratively in real time, rather than just periodically.

Democratising knowledge in real time

Assuming a smart data solution with robust entitlement controls is implemented, it becomes possible to provide each user with access to precisely the data and analytics they need to execute their role more efficiently. Furthermore, if the solution is also structured to be open, then in addition to its own analytics it will also be possible to integrate proprietary analytics and tools developed in- house. Users will therefore potentially have access to best in class internal, external and alternative data sources and analytics.

The ability to integrate proprietary analytics makes it possible to disseminate quantitative expertise throughout the business extremely efficiently, in effect giving users access to a “desktop quant”. This not only helps users maximise profitability, it also maximises quants’ available time for further research. Finally, the combination of fine-grained data and best in class analytics also enables productive scenario modelling across multiple time frames, from very short-term tactics to long-term strategy.

More than human intelligence

A smart data solution that makes available a large repository of clean consistent transaction data represents a major opportunity for artificial as well as human intelligence. As mentioned earlier, data scientists and quants will also be able to work far more effectively in developing AI/ML tools if they are no longer hamstrung by deficient data sources.

While in many instances AI and ML have been seriously over-hyped, in the case of an FX business the immediate opportunities are genuine. One example is the extension from humans to machines of the fine tuning of counterparty relationships mentioned earlier. Other business sectors (e.g. online retail) have long been doing this by mining and analysing client transaction and interaction data and then using AI/ML to influence future client behaviour and hence profitability. This is equally applicable to FX (and FICC more generally). For instance, automated AI/ML identification of client business leakage and automated corrective responses – e.g. adjustment of pricing (within limits) is just one of many possibilities.

Conclusion: smart data + smart analytics = smart outcomes

In the current market environment, many FX businesses need significant re-engineering to remain viable. While at first glance regulatory data requirements exacerbate this situation, the good news is that regulatory compliance can also act as the foundation for profitable transformation.

While some may wish to supplement it with external sources, the bulk of the information needed for this transformation is already within the enterprise, so major and costly data acquisition is not needed.

Furthermore, investing in making existing data smart delivers a long-term return. Smart data and smart analytics can certainly be used to achieve profitable results in the immediate term, but equally (if not more) importantly they can also serve to future-proof the business. Responding to future change more effectively is only part of this opportunity; those who make optimal use of smart data and analytics will also be able to anticipate and prepare for change far more efficiently and profitably.

1 https://www.bankingsupervision.europa.eu/ecb/pub/pdf/ssm.BCBS_239_report_201805.pdf “…the implementation status of the BCBS 239 principles within the sample of significant institutions is unsatisfactory…”

2 https://www.bis.org/bcbs/publ/d443.pdf

3 https://www.forbes.com/sites/gilpress/2016/03/23/data-preparation-most-time-consuming-least-enjoyable-data-science-task-survey-says/