Steps Ahead

Q&A with Warren Rabin, Head of Macro Sales in America at J.P. Morgan & Scott Hamilton, Head of Macro Sales in Europe at J.P. Morgan

5 November 2018

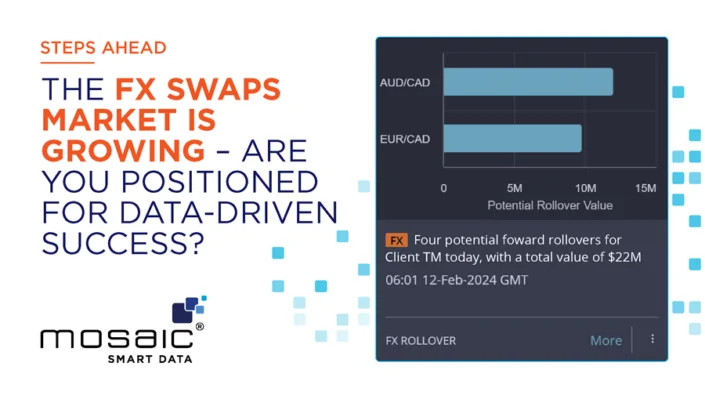

How can data analytics technology benefit a bank’s swaps business?

Warren Rabin: Banks are operating in an increasingly data-driven environment. As the volume of data linked to trading activity and interactions with clients grow, the challenge of harnessing and analysing that data in real-time has become more critical.

One of the first benefits a bank will see when deploying analytics like Mosaic Smart Data’s MSX platform is the ability to combine its electronic and voice traded swaps transaction data into a single view. It can then unlock the true value of this data for descriptive and diagnostic purposes across all channels in real time. Also, and arguably more importantly, it allows you to identify unique insights relevant to each client so that you can anticipate their needs and service them in a highly tailored fashion.

In swaps, given the complexity, size and breadth of the market, one of the key areas where we can gain new insights is in risk management. Often, swaps positions are re-evaluated and repriced at the end of the day. With the MSX platform, all the transaction data is streamed in real-time, so it allows for instant insight into our client flow and risk across all channels including both voice and electronic activity. The productivity and efficiency gains of this technology are clear and are a significant boost to our sales teams who are increasingly measured in a more quantitative way as they set about improving our client relationships.

By better understanding our franchise flows compared to market trends, it provides an ability to identify noteworthy insights. For instance, spotting trends where clients are transitioning from LIBOR to SONIA in GBP Swaps while at the same time decreasing their demand for OIS (Fed Funds) Swaps in USD, pinpoints observations otherwise lost.

What trends are you seeing in the swaps market in regard to how banks interact with their clients

Scott Hamilton: We continue to see banks make strategic and technological choices that will enable them to become more client-focused. This is a sensible and natural choice – in the current swaps market, the buy-side naturally expects more for less, and if banks want to find new revenue streams, they need to work harder to deliver for their clients.

Data is a crucial component to becoming more client centric and sales teams need to add value with a solid foundation of quantifiable analytics and insights. These insights can also tell teams precisely who their most valued clients are, which relationships can and should be maximized and which need more attention. It’s all about providing actionable intelligence in a simple and easily comprehensible format. Users having to delve into large datasets in unwieldy spreadsheets in the hope of identifying a theme or trend should be a thing of the past, and so simple and easy to navigate software that answers complex questions at the speed of the user’s thought is a welcome development.

With banks increasingly absorbing advanced data and compressing them into identifiable behaviour outputs, they are able to provide a far more customized experience for the client and, in turn, this allows the sales person to make more informed recommendations

What kind of insight can effective data analytics give the sales team to help clients with their swaps trading activity?

Scott Hamilton: Once all a bank’s electronic and voice traded swaps transaction data is combined into a single real-time view, we have a far more precise and accurate understanding of the flow activity at any given moment. This allows us to provide our clients with empirical (as opposed to anecdotal) market insights. Clients value flow information across a large franchise highly and understanding and anticipating our clients’ needs is our primary sales objective. Being able to do this creates a shift away from commoditized relationships based purely on price.

On the defensive side of the equation, if you’re able to be more attentive to what clients are looking for, you reduce the chances that they do business elsewhere. It simply makes good business sense to protect relationships that we already enjoy – it’s much cheaper to keep a client than acquire a new one.

How has Mosaic Smart Data delivered these analytics into J.P. Morgan and what are the key deployment considerations?

Warren Rabin: Mosaic’s MSX platform translates data into a single messaging language and then enriches that data with other sources to fill any gaps. The clear benefit of this primary stage of the analytics process is that with harmonized and clean data, any number of benefits are available. In the case of MSX, we gain far deeper insights and we think that improves our performance with our clients. That being said, we recognize that clean transaction data is beneficial for compliance, surveillance, regulation reporting as well as for risk analytics.

What we found by engaging with Mosaic Smart Data after a short pilot program was the quick time to market, how intuitive and user focused the front-end software is and how rapidly we have been able to roll it out across our global business.

Taking full advantage of the power of analytics requires an end-to-end approach, which includes training staff and driving behavioural changes within the organization. However, getting the integration of the core technology right is the cornerstone upon which the rest of a successful analytics project is built.

Judging by how rapidly our teams have adopted the platform and brought it into the daily workflow, it is a testimony to the benefit of finding a company that truly understands our needs.