Smart data in FX markets

So, what does this all mean for FX markets? FX trading is, of course, based on any number of real-world situations. Whether counterparties want to arrange a spot contract, or an airline is looking for a forward option to buy fuel, or corporates want to manage their FX exposure in any given region, the need for accurate and timely data is key. The issue is naturally made more complex by changeable geopolitical and socio-economic factors; the on-off trade war between the US and China, and the drawn-out Brexit process between the UK and the European Union (EU), are both factors in the FX ecosystem.

Ahead of the US election in November, Donald Trump’s actions may be seen as a ploy to win voters. Yet a Bloomberg article suggested that his pledge to double exports to China will not bring the gains he anticipates; it indicated that lingering tariffs are likely to drag on, hampering business investment and leading to a loss of GDP of up to USD 316 billion by the end of 2020.

For the UK, trade negotiations with the EU and new arrangements with other countries will be complex, with uncertainty continuing until deals are finalised. And tensions in the Middle East – and between the US and Iran – are an ongoing cause for concern. Whatever happens on the world stage, the unpredictable nature of international relations has a huge effect on the FX market.

Of course, these aren’t the only influences. The FX market is moving further into electronic trading. Algorithms that lead to automated currency trading can operate faster than any man or woman on an FX desk.

If humans are to compete with fast-paced automated trading terminals, companies should consider collaborating with specialised fintech partners to take advantage of their innovative technologies. JP Morgan is well-known for incubating emerging tech companies through its In-Residence Program, and it is this forward-thinking attitude that enables the bank to remain at the pinnacle of the financial industry.

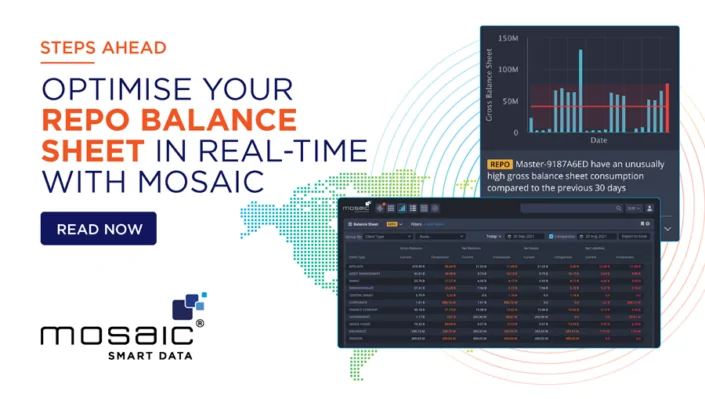

Resilience in FX markets can be leveraged by the use of sophisticated smart data analytics – that is, not just gathering big data, but gaining a 360-degree of the market. The questions all market participants ask are ‘what is happening, why is it happening, and what will happen next?’. And to fully realise those questions, the use of an analytics platform that offers guidance towards opportunities – and conversely, information on what to avoid – as well as showing context for those options, provides huge scope to move forward in FX markets.