The view from across the street

Sell-side desks have seen their service model undermined while revenues fall; The DESK looks at the re-arming and re-skilling of the bank dealer.

Credit dealing desks are fighting to deliver efficient service for buy-side clients in the face of falling income and a fractured market.

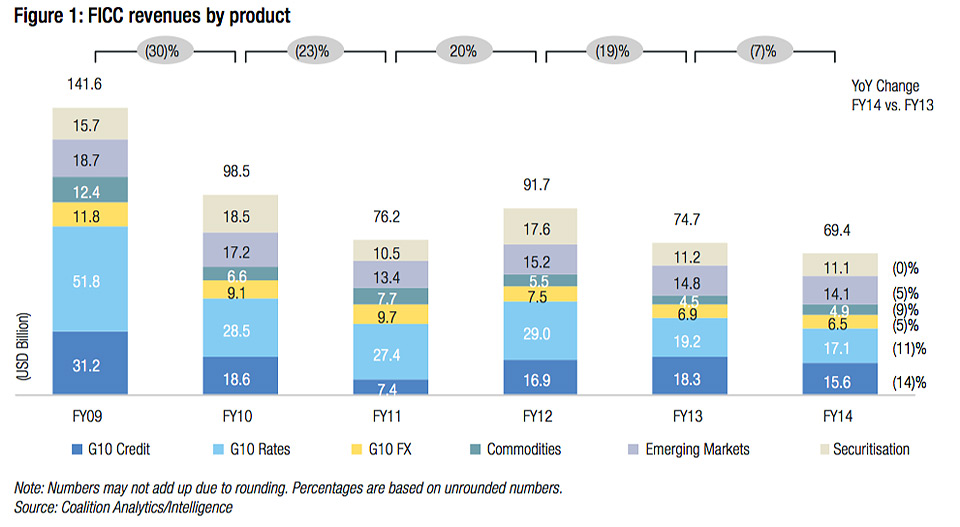

Revenues for banks in the corporate bond space fell 14% in 2014 against the previous year, (see Figure 1) and have halved since 2009.

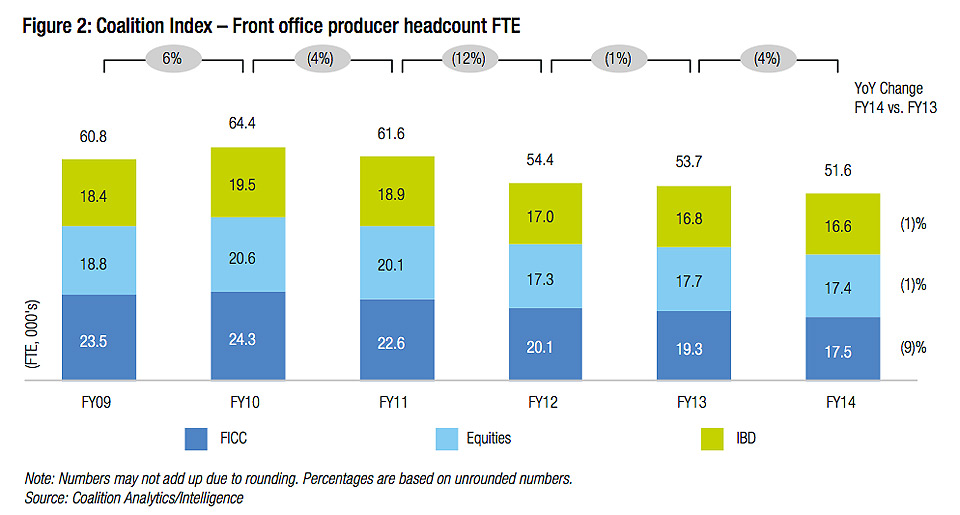

Front office head count in fixed income, currencies and commodities fell 9% in 2014, following a trend that has seen a decline of 27.3% since 2010 (see Figure 2) according to analyst house Coalition.

Dominic Holland, head of credit at Deutsche Bank says, “In the eCommerce industry overall there has been a reduction in the number of traders and a reduction in the average age/experience of those people.”

George Kuznetsov, head of research and analytics at Coalition, says, “The question now is; have the cuts been enough? From our perspective this depends on technology development to get greater efficiencies. Further cuts in front office headcount would be very difficult to achieve unless the banks want to exit businesses.”

Banks are striving to overcome the impact of Basel III, the capital adequacy rules that have been rolling out since 2014, and allow less warehousing of risk. Some technologies, such as those which help to provide pre-trade price and liquidity information, have been adopted by sell-side firms in an effort to increase turnover of the inventory that is held.

Mark Russell, global head of Bond Execution Services at UBS Investment Bank says, “Dealers have become more selective in what they do with their available risk limits. Increasing velocity is a key part of a traders mandate as they navigate regulation ranging from Basel to Volcker. This inevitably means turnover will have to increase.”

Although more data is being consumed by desks, for the most part technology has not transformed that much in the last three years; traders still use amalgamators to pull information together from request-for-quote platforms, says Niall Cameron, head of credit, HSBC.

“The change is probably more in terms of the trading style; it is not really agency, because there is nowhere to place the orders as such, but you have more of an order-working and order-taking type of business,” he says. “And so we see risk getting matched off or turned over more quickly.”

In some cases sell-side firms are looking for simple answers to the problem says Kuznetsov: “There are banks – and this is not a consensus across the street – who feel that if they focus on flow fixed income businesses without complex transactions, then it is OK to run junior sales and even trading teams.”

A key development will be banks’ capacity to evaluate clients, so that sell-side traders and balance sheet can both be put to the most effective use. Matt Hodgson, CEO at Mosaic Smart Data, a fixed income data analytics provider, says that this is one area in which brokers need investment.

“We are focussed on an analytics initiative and understanding the performance of client activity from a profitability and a market-share perspective,” he says. “That allows the bank to understand which clients they can effectively service. Within the eco-system the key is: how do you boost the productivity of individuals in an investment bank, when the cost pressures and regulatory drivers are migrating towards electronic trading?”

Europe has seen a greater proportion of automation than North America. Analyst house in credit trading, Greenwich Associates estimates that 50% of European investment grade (IG) volume and 19% European high yield (HY) volume was traded electronically in 2014, compared to 14% for US IG credit and 4% for US HY credit. Consequently in the secondary market average ticket sizes have changed, with a much higher number of smaller tickets and larger tickets.

Holland says, “It is the middle ground that has disappeared; I think investment strategies are being expressed via larger trades and rebalancing portfolios is being managed via smaller tickets.”

The change in style that the banks need in order to support clients is demanding that the new traders on the block – and those adapting to the new environment – need a different tool kit to traders in 2008.

Cameron says: “If you are risk taking you need good trading skills or good credit skills. If you move into more of a facilitation style you need to be good with technology, good with data and very active during the day getting prices out and getting things moving.”

Partnership in uncertainty

Over this period buy-side has increased the number of people in charge of execution, moving away from the model of portfolio managers making trades, even within smaller fund managers. Early adopters of execution desks are now moving towards a greater integration of execution desks with the portfolio manager, using systems and data sources to offer pre-trade advice on what is available, while late adopters tend toward independent execution desks.

Holland notes that on the buy-side the quant trader role, which typically functions by connecting investment and trading decisions between the desk and the PM, is less sophisticated in credit than in equities, however he expects to see that role expand under MiFID II, due to come into effect in June 2016, as a lot more data around execution becomes available.

“MiFID will increase pre-trade transparency, post-trade transparency and in-trade transparency with systematic internalisers (SIs) having to make their quotes available during the trade process to the market,” he says. “People will try and work out which market maker traded, which SI it was on and where the price points were. That is only starting to be focussed on now as the final rules of MiFID become clear.”

The rules could also potentially accelerate the trend towards electronic trading, adds Cameron.

“The final rules for MiFID II are yet to be seen, so we can’t speculate on their impact,” he says. “As a general point, when regulation and reporting rules become more complex, voice execution can become more difficult, making automation of execution more necessary.”

Electronic market places are proliferating in the credit area, with many launching in 2015, although the incumbent platforms of Bloomberg, MarketAxess and Tradeweb retain a dominant market share. With the liquidity from existing platforms potentially fragmenting across multiple new venues, there is marked uncertainty as to how they should approach the platforms.

The need by clients for a greater understanding of market structure and an enhanced ability to use data to support trade decisions is leading sell-side desks to offer services to support their buy-side counterparts through this uncertainty.

“We do see the execution advisory role, which runs under a plethora of names, as the future,” says Cameron. “At present it is not necessarily housed in one place but over the next 12-18 months I think it will become more of a defined function.”

©TheDESK 2015