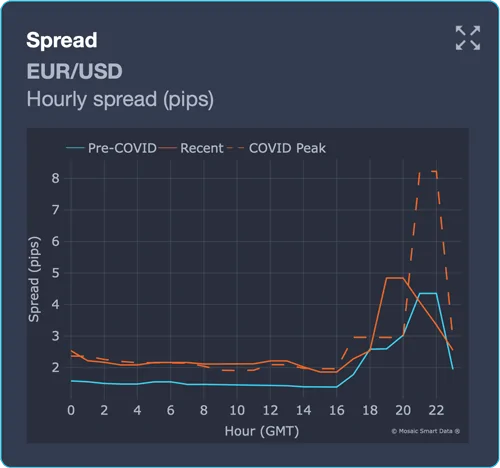

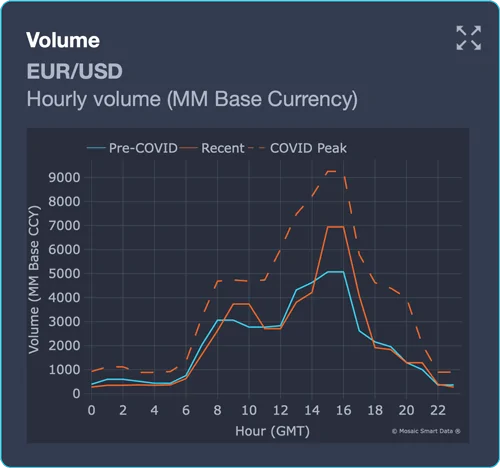

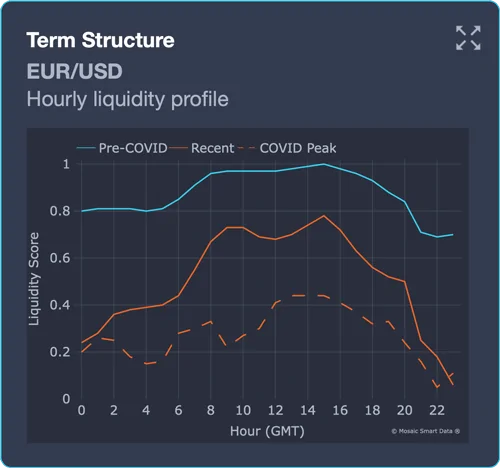

Analysis of FX market liquidity data was carried out from 1st June 2019 to 20th February 2020 to set a pre-COVID-19 base line. The data was compared to corresponding data from the 21st February to 20th March (COVID-19 peak), as well as more recent data from 18th April to 10th May. The data indicates that liquidity is now improving, but not in all currencies and not consistently throughout the day.

Improvements in liquidity are patchy. USD/JPY was largely shielded from disruption throughout the crisis, while EUR/USD liquidity (above) has returned to nearly 80% of its pre-crisis level. However, the analysis reveals that other currency pairs are still stressed. In particular, liquidity falls off sharply outside of trading hours and it is still almost as poor as at the peak of the health crisis (see charts and commentaries for the 11 currency pairs analysed).

Additionally, the data indicates that spreads have narrowed from the peaks in JPY, AUD, CHF, ZAR and HKD currencies. However, they remain elevated for EUR, GBP, CAD, NZD, MXN and SGD. For further analysis, see charts and commentaries.

This collaborative analytics project provides the FX market with transparency as the market continues to experience high levels of volatility.

The economic impacts of the current global health emergency have profoundly changed the FX environment, and MUFG identified a need for market participants to have additional visibility and insights into liquidity and volatility. Developed from the ground up over a few weeks, these new analytics harness CLS’s robust, aggregated FX market data, MUFG’s aggregated FX order book data and Mosaic Smart Data’s advanced analytics software. The benefit of this collaboration is to provide the FX community with greater transparency into FX market conditions.

Mosaic Smart Data will publish this analysis weekly, providing users with an ongoing, data-driven view into liquidity changes across key currency pairs. Accessible via a dedicated portal and free of charge, the analysis is provided by Mosaic Smart Data’s platform, and the platform’s Natural Language Generation (NLG) technology then generates instant written reports to provide insights on key aspects of the data.

John Winter, CEO of MUFG Securities EMEA, and Head of Global Markets and CIB at MUFG in EMEA, said:

“The economic consequences of the COVID-19 pandemic are truly staggering, and unlike anything experienced before. Clearly, the way in which economies across the world are rapidly adjusting creates many new variables which can be fast-moving and difficult to navigate. We wanted to provide a service to our corporate treasury and institutional clients to help them to better understand what is going on and how the situation is developing in as much detail as possible. Being able to access insights drawn from CLS’s broad view across the markets is a significant part of the solution in rapidly understanding how liquidity flows are evolving.”

Matthew Hodgson, CEO and Founder of Mosaic Smart Data, said:

“Advanced analytics and access to the right data are a prerequisite for operating at peak levels in the modern FX markets. That need has only intensified as markets adjust rapidly to one of the biggest changes in global business in decades. Access to timely and relevant insights into market behaviour is vital. The analysis we are providing through this project extracts unique and highly actionable insights from CLS’s executed FX trade data which participants will be able to use to navigate uncertain markets. We’re proud to be able to provide this service to the market at this difficult time.”

Masami Johnstone, Head of Information Services, at CLS, said:

“CLS’s identity is rooted in developing services that help FX market participants navigate risk and improve operational efficiency and liquidity, especially during challenging times. Following the outbreak of COVID-19, a number of institutions expressed a need for greater understanding of market behaviour as well as their own trading activity. CLS provides a unique view of the market, offering an unparalleled opportunity to create new, innovative insights leveraging CLS FX data. With its advanced analytics and software architecture built specifically to manage the high volumes of FX data, Mosaic Smart Data was a great fit for this analysis.”

Professor Rama Cont, Chair of Mathematical Finance at the University of Oxford and Chief Scientific Advisor to Mosaic Smart Data said:

“In turbulent market conditions such as these, real-time market analytics are more valuable than ever for guiding timely decisions by market participants. I am delighted to have contributed to the methodology and independent validation of the models being deployed, which combine the unique vantage point of CLS on FX markets with cutting-edge analytics from the Data Science team at Mosaic Smart Data.”